How big is the largest real estate investment trust (REIT) in the world?

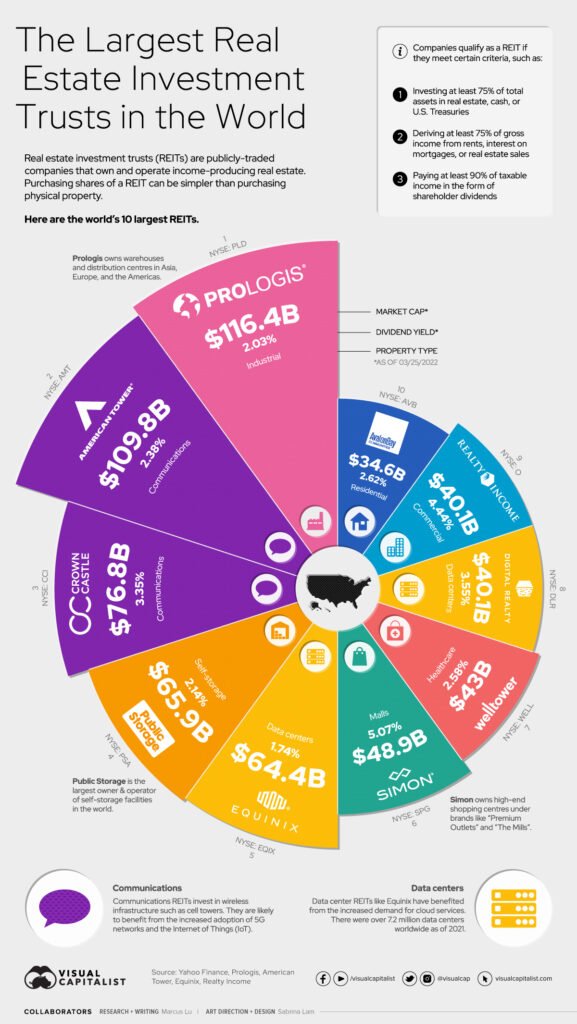

The largest is PROLOGIS and it’s an industrial property based Real Estate Investment Trust (REIT). The market capitalisation of the fund is a whopping US$116.4 Billion. (RM592 billion). The size of the economy of Malaysia is US$415 billion. In other words, PROLOGIS’s market capitalisation is equivalent to 28 percent of Malaysia’s GDP. Yeah, just one of the top 10 largest REITs. meanwhile if we add up all the top 10 largest REITs in the world, it’s market capitalisation is US$640 billion and just these 10 funds alone are already larger than the economy of Malaysia. So, it’s good to continue to invest into real estate just what these funds are also doing too.

Meanwhile if we look at just the returns alone from these top 10 largest REITs, then the REIT with the highest returns are the one invested into malls. It gives a return of over 5 percent. Haha. Yes, malls are also definitely not dying yeah. Here’s one latest article with numbers too. Are malls dying all over the Klang Valley? The second highest would be one invested into commercial properties with a return of 4.4 percent. Please take a look at the image below from www.virtualcapitalist.com

What about the REITs in Malaysia then?

Our REITs are definitely worth taking a closer look. Their returns are also considered very vibrant when compared to the top 10 ones as above. 5 Advantages of REITs for first time investors.

I do not currently own any REIT stocks but I guess this is just a preference since I love to buy a property directly versus having someone doing the investing for me. The one big thing I am unable to do is to buy into any malls. However, I could choose to participate in the mall’s growth by investing into REITs which are focused on malls yeah. As the top 10 image above showed, the one focused on malls have the highest returns yeah. All the best in your investment.

Property News Malaysia? Sign up for daily investment news updates (FREE since Nov 2013 and FOREVER). Alternatively, Follow me on Telegram here.

Please LIKE kopiandproperty.my FB page to get daily updates about the property market beyond kopiandproperty.my articles. Else, follow me on Twitter here.

Next suggested article: Property is no longer a key retirement asset

Leave a Reply