5 Advantages for REITs for first time investors

If you have been reading kopiandproperty.my for a while and thinks property investment is interesting but you may not have the necessary down-payment yet, then perhaps Real Estate Investment Trust (REIT) can be a stepping stone too. In fact, there are many advantages for REITs too when compared to going into buying a property itself. Here are 5 advantages of REITs for your reading and understanding.

Here are the 5 advantages of REITs?

#1 – Super affordable to start. A RM500,000 property means we need a minimum of RM50,000 just for down-payment. Well, with a REIT, we do not need 10% down-payment to buy. We can have RM500, RM5,000 or even RM50,000 and we can still choose to start with buying the REIT stock we love. There are many choices, so just choose the one we like the most by knowing which property they manage. In fact, we could just choose to buy as much as we could afford too.

#2 – Liquidity. Unlike buying a property which will take months or at least weeks if we could afford to buy via cash, when it comes to REITs, we can buy today, sell today. We can also buy today, sell 3 months later. The timing is really up to us. Here, we have liquidity when we need them. Suddenly we found something we must buy? Just sell the REIT and get the money to invest / buy in days. This is unlike buying a property which will take many months to complete the buy and another few months to sell.

#3 – Steady dividends. When we rent out our property today, we may not even have positive rental yields. Let’s not even talk about steady dividends. Well, when it comes to REITs, they usually declare as much dividend payout as they could unless they need the money for further acquisitions. So, every year, the investment will give returns. Steady dividends would be something expected too unless some unforeseen circumstances happen to that property which was being managed.

#4 – You ‘OWN’ a commercial property you love to visit. Every time we visit a mall we love, don’t we wish that we are the owner of the mall? Well, with a REIT we would. We can choose to buy that particular REIT and now we can proudly say that we are the “owner” (partial owner is still owner okay…) of a famous and popular mall. So moving forward, we can say I am visiting my mall and contributing to its success too. Haha. Anyway, many property “experts” also tell everyone they own 50 properties etc… Some times, these ownership is just a 1% stake. So, if they could claim, you can claim to own the mall too. 😛

#5 – Professional management. It’s not possible to be able to manage all our property investments easily unless we are professionals with years of experience. This is why sometimes it’s best to leave all these management to the professionals. Well, when I referred to some of these REIT mangement teams, I do think the professionals who are managing these REITs are experienced people. Usually with years and years of real estate industry experience too. So, their decision will be better than ours too.

How to start?

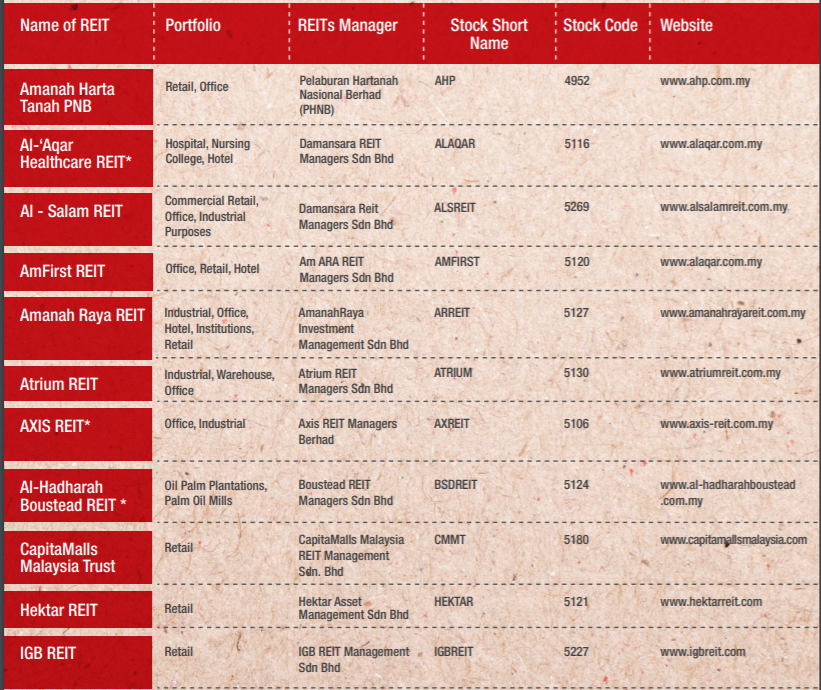

If we think these 5 advantages are good, then Here are the list of all the REITs in Bursa currently Screenshots as below for an overview. There are also the websites for every REIT for reference.

Read more about REITs here from Bursa Malaysia too

Why I should not buy a REIT then?

There are many reasons. First one is that you think earning a salary is good enough and investments are not really necessary. By the way, I have friends who are in senior management even before they reach 40 and they are earning incomes of over half a million every year and does not even own a car! We had coffee session recently and she was still wearing the same shirt which I have seen over 5 years ago! So, if we earn so much and we do not simply spend, of course we do not need to invest.

Second one is that we are just allergic to property. Many years ago, a friend told me that every time she buys a property, it will not work out well. Well… she bought into a small office unit at RM950 per sq ft because she was promised that the rental will cover her mortgage. It did not work. She also bought another property which she is staying and it’s nearby everything she loves. She said the price appreciation is very low. Erm… if we buy into a fully appreciated area, we will need a much longer time versus just 1-2 years. So, she is now ‘allergic’ to property kind of investment… Maybe should skip REITs too.

Okay, enough of reasons. I am not selling REITs anyway. I also have no specific REIT recommendation too. So, invest or no invest, you decide lah. Your future is yours and my future is mine. Action is louder than words. All the best in your investment journey in the real estate world or outside too.

Property News Malaysia? Sign up for daily investment news updates (FREE since Nov 2013 and FOREVER). Alternatively, Follow me on Telegram here.

Please LIKE kopiandproperty.my FB page to get daily updates about the property market beyond kopiandproperty.my articles. Else, follow me on Twitter here.

Next suggested article: Investing is as exciting as watching the grass grow

Leave a Reply