Property developers, which is bigger, which is more attractive etc?

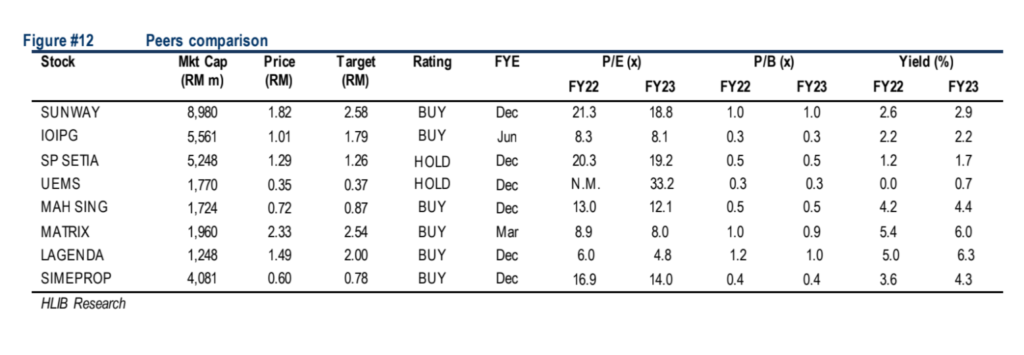

I read a Hong Leong Investment Bank research report a few days ago. (click here to download the full report if you like to refer to it) There are many interesting views and I have extracted one which I think provides an easy overview to everyone who just want to look at the property developers side by side in terms of actual numbers. Please refer below for a peers comparison among the listed property developers in Malaysia.

Biggest property developer among the companies under spotlight by HLIB?

Sunway is the biggest with a market capitalisation of RM8.98 billion. Buying 1,000 units of Sunway is not too hard to do. It’s just RM1,820. (as at 8th April) This is then followed by IOI at RM5.561 billion market capitalisation. Buying 1,000 units is just RM1,010. (as at 8th April). Then comes S P Setia at RM5.248 billion market capitalisation and buying a 1,000 unit would need an investment of just RM1,290. Ratings are BUY – BUY – HOLD respectively.

Highest yield? Higher return is always better.

For FY22, Matrix has the highest yields. In other words, buying the share and the dividend which one would receive is potentially 5.4%. This is a very good number especially if compared to the fixed deposit rate. The next in line where dividend return is concerned would be Lagenda, with a dividend yield of 5%. The third highest would be Mah Sing with 4.2%. So, if you are looking at returns, then these three does provide the opportunity.

Highest potential price appreciation?

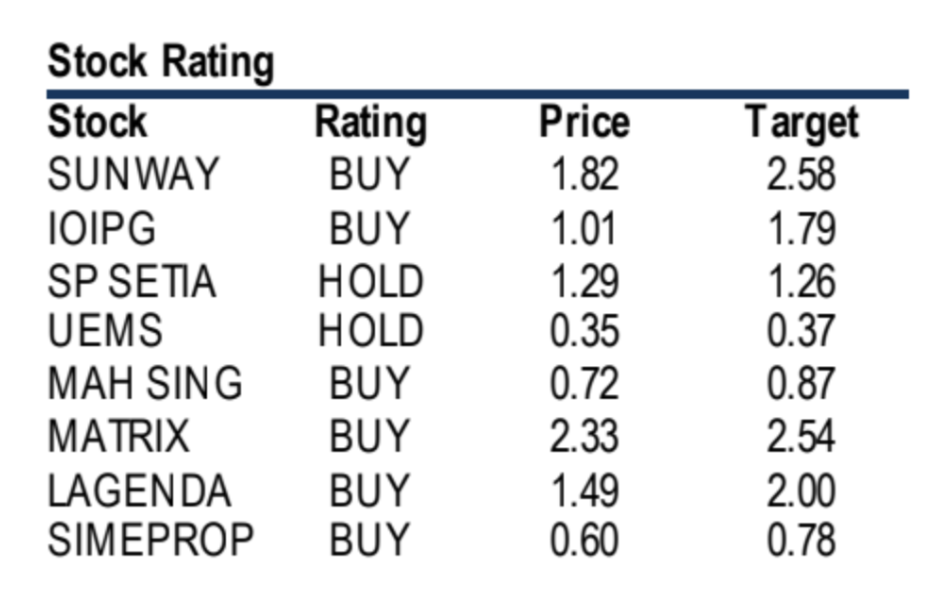

Using potential % increase, the highest three developers for current price versus target is IOI Property, followed by Sunway and then Lagenda and Simeprop, almost the same. IOI Property has a potential price appreciation of 77%! Yes, it’s really high. Just need to remember target price is just target price. It may or may not come true.

If we look at the potential price increase in absolute number, then it’s 78 sen for IOI PG, 76 sen potential for Sunway and 51 sen for Lagenda yeah.

Property Investment is not just about buying the property

It can be a property or it could be property stocks yeah. Look at the ones highlighted today and take your pick. As usual, these property developer stocks can only do well if their property developments do well. In other words, we can use the performance to also gauge the attractiveness of the properties they are selling too.

We can also see that it’s generally quite affordable to buy any property developer stock from the current price too. Happy deciding.

Property News Malaysia? Sign up for daily investment news updates (FREE since Nov 2013 and FOREVER). Alternatively, Follow me on Telegram here.

Please LIKE kopiandproperty.my FB page to get daily updates about the property market beyond kopiandproperty.my articles. Else, follow me on Twitter here.

Next suggested article: Property is no longer a key retirement asset

Leave a Reply