Bank Negara Malaysia (BNM) today published its Annual Report 2021 (AR 2021), Economic and Monetary Review 2021 (EMR 2021) and Financial Stability Review for Second Half 2021 (FSR 2H2021).

Source of all the charts below is from Bank Negara Malaysia (BNM) site.

Economic & Monetary Review 2021

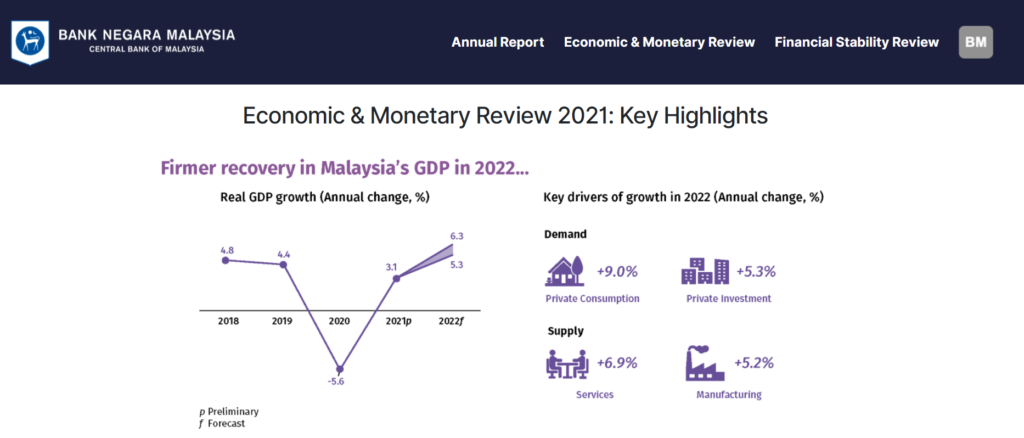

As per image above, BNM is expecting the GDP growth to be higher for 2022 versus 2021. The few key drivers include private consumption (me and you…), private investment, services and manufacturing. If all these four moves, the GDP will continue to move positively too.

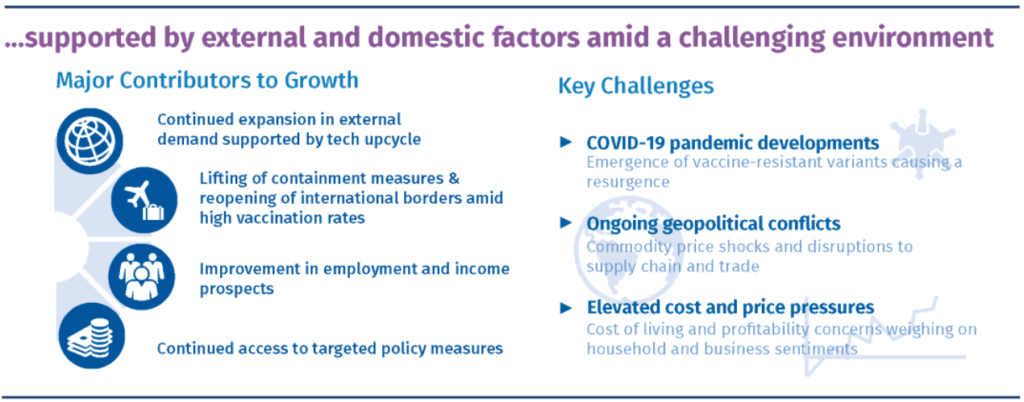

As per image below, these will contribute to economic growth. Expansion in external demand supported by tech upcycle. International borders reopening… (1st April 2022) (here’s latest article) Unemployment numbers continue to drop. (here’s latest article) There are also targeted policy measures to push for more targeted growth as well.

There are challenges yeah. What if Covid-19 virus becomes more powerful. There are also the geopolitical conflicts. The most significantly reported one is Russia-Ukraine war. Last but not least would be inflation… (Latest article here)

Below image shows our inflation numbers. it’s generally on an uptrend but I think we are also shielded because of the subsidy for petrol versus other countries where the petrol price is determined by the market instead. I am just not sure how long can subsidy lasts if oil price continue to be at elevated levels.

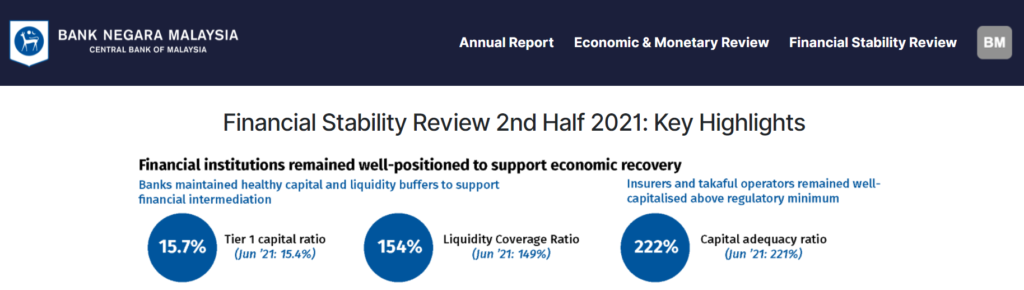

Financial Stability Review. This is about banking institutions. Based on the image below, we can safely conclude that the banking institutions are at a position of strength at the moment. Tier 1 capital ratio of 15.7% is considered a very high number even when compared to most countries in the world. (I have no idea if there are that many countries which has a higher number than 15.7%. Singapore’s Monetary Authority asks the banks in Singapore to have a minimum of 9%)

The liquidity coverage ratio (LCR) refers to the proportion of highly liquid assets held by financial institutions, to ensure their ongoing ability to meet short-term obligations. (as per Investopedia). This meant that banks are able to continue lending to people.

The capital adequacy ratio (CAR) is a measure of how much capital a bank has available, reported as a percentage of a bank’s risk-weighted credit exposures. The purpose is to establish that banks have enough capital on reserve to handle a certain amount of losses, before being at risk for becoming insolvent. (as per investopedia) This means banks do not suddenly have to stop its operations due to some sudden financial losses.

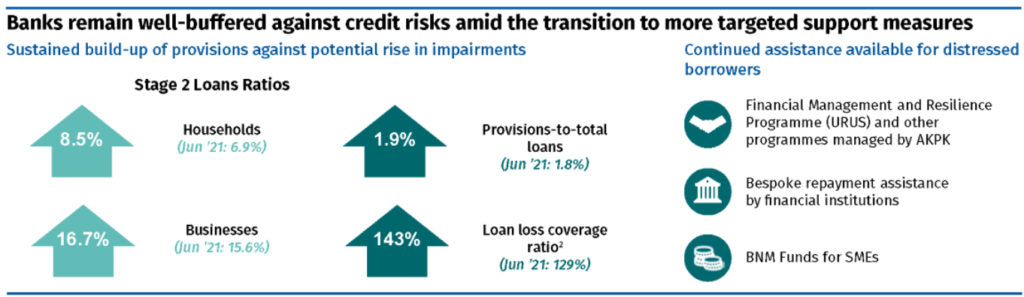

From the image above, we could see impairment ratio remains very low. This meant two things. People could repay their debts and very little goes into bad debts. Secondly, the banks are careful with their lending and only the ones would meet the requirements could borrow from the bank. I think this is also why people say it’s not easy to get a loan approved.

The above image showed that businesses are borrowing more versus households. This is good because businesses borrow to expand their business and this will create more jobs for the people. Loan loss coverage is more than enough to cover all the potential losses.

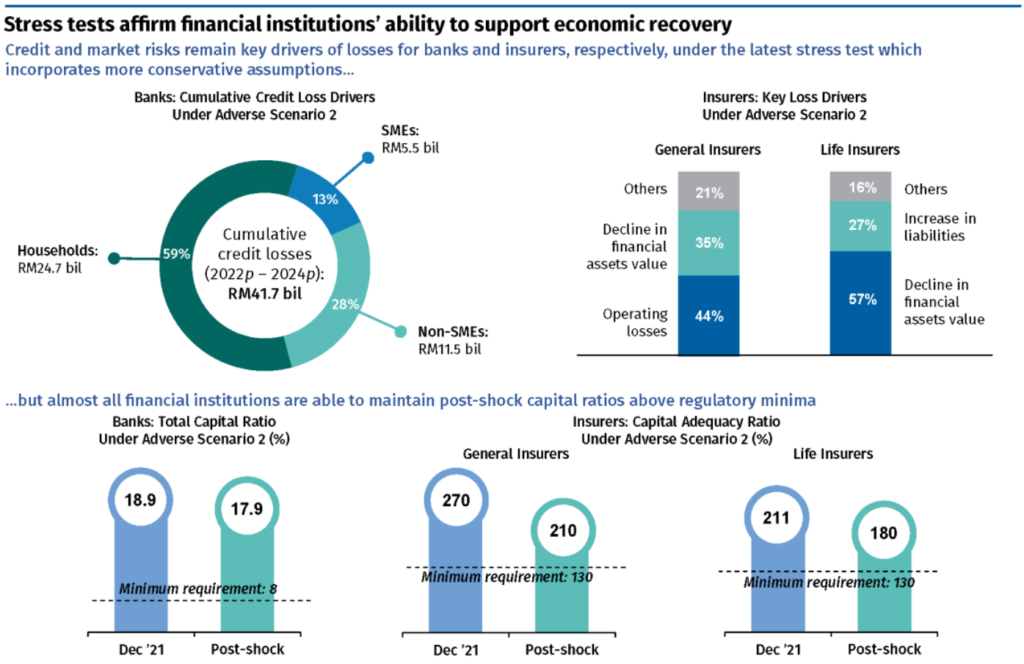

Image above shows a positive number yeah. It seems that the financial market stress is going lower versus when the pandemic started. Meanwhile image below shows that whether banks, general insurers and even life insurers, all are able to handle a sudden stress to them.

Happy learning that Malaysia is really doing fine at the moment. Here’s the BNM website link again. Bank Negara Malaysia (BNM) site.

Property News Malaysia? Sign up for daily investment news updates (FREE since Nov 2013 and FOREVER). Alternatively, Follow me on Telegram here.

Please LIKE kopiandproperty.my FB page to get daily updates about the property market beyond kopiandproperty.my articles. Else, follow me on Twitter here.

Next suggested article: 5 Must-Do steps for property investment.

Leave a Reply