Property investment is for older folks and not millennials?

SOME people say property investment is no longer attractive like previously. No idea what they meant by previously but it’s okay. As much as they can share, I can also share. For these SOME people, they either have their own agenda (as usual they have their own investment plans to sell you) or they actually do not have property investment(s) and thus do not understand what is property investment.

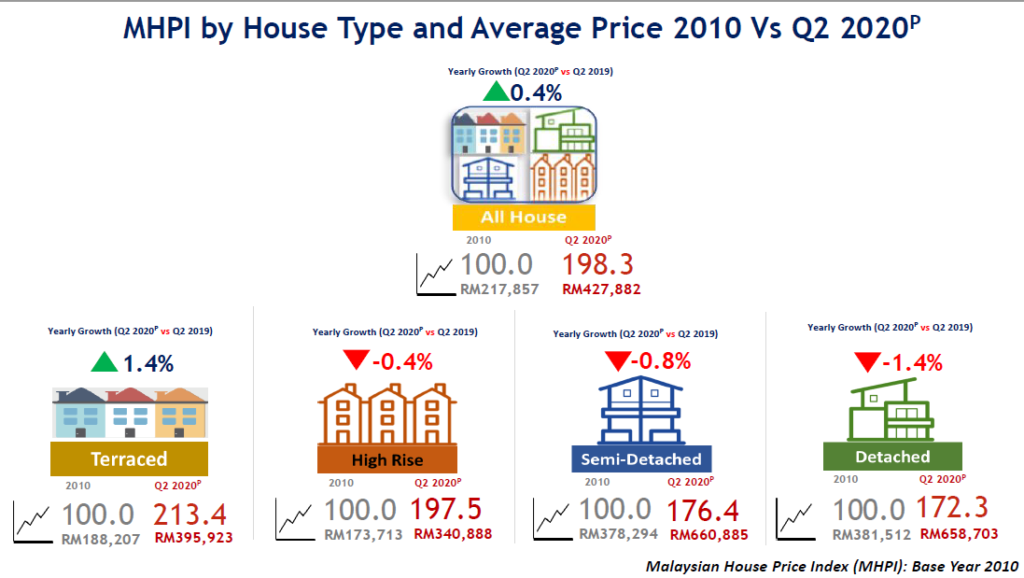

Anyway, just need to look at the chart below showing you the property price trends for ALL types of properties.

Now, let’s listen to some other views too.

Article in thesundaily.my Older generation tend to put their money in properties and blue chip stocks while the millennials are not interested. Financial planner Felix Neoh shared that the current property market has made investors think twice before committing due to their reluctance to borrow for investment.

He said, “The risk of investing in properties depends on one’s ability to meet the repayment commitment.”

“It is less risky if you buy to stay at the property. But if it is for investment, the risks (involved) are if the price falls, if you can’t get a tenant at the expected rental value, or if you have income concerns.”

Another financial planner, Ian Wong said, “While stocks are still a good option, not all properties make money. In fact, a bad property purchase ends up severely damaging your finances. There are lot more bad properties nowadays.”

Author of financial book Enam Angka Menjelang Dua Puluh Lima, Muhamad Azraei Idros meanwhile shared that high inflation and low salary have made buying property no longer an attractive investment for young people. Please do read the article in full here. Article in thesundaily.my

Millennials are not interested?

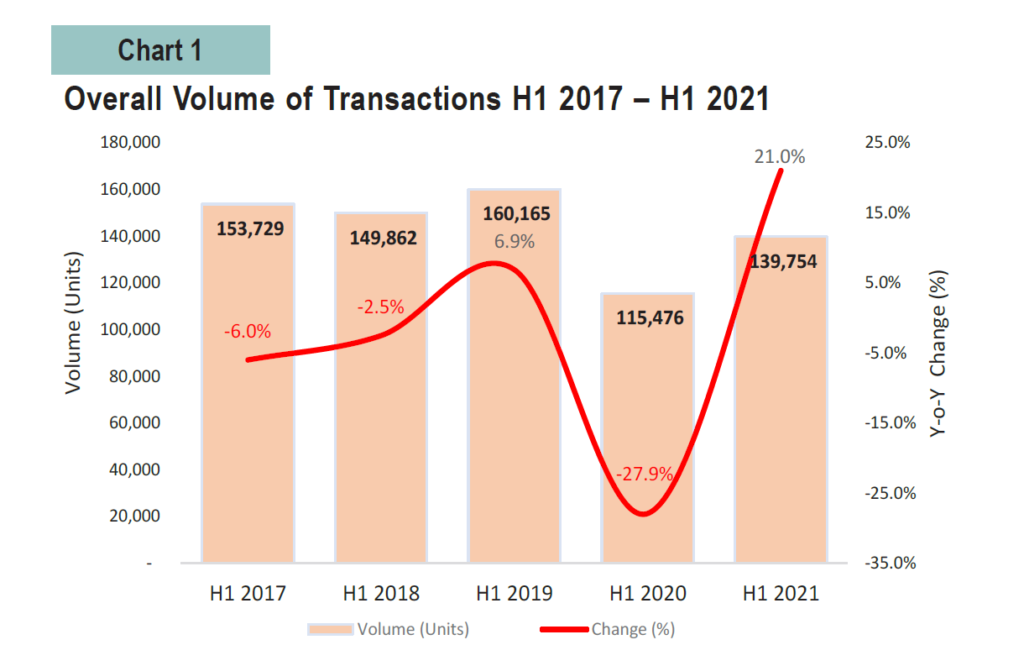

The below shows the total transactions just for half year. The average is probably around 140,000 units per half year. Means all these 140,000 are all OLDER folks? Millennials (born 1981 – 1996) are between the ages of 26 to 41. Does this mean that all the buyers for these units below 9as per the chart) are all either below 26 years old (must have super rich parents maybe?) or above 41 years old? (finally saved enough money to buy?)

Wow… How fascinating indeed if indeed millennials are not interested… with property investment.

If price falls and you cannot get tenant?

This is true… right? Well, it’s the same with many other so-called newer investments too right… If the price of that investment which the millennials love actually falls… does the millennial sell quickly and lose money or does the millennial hold on to it until it comes back? Are there investments out there where after we invest into it, the price never falls and it just keep going up every month, every year and forever? If there is such an attractive investment why do we still need professional financial planners who must explain the risks of investments to the millennials?

Guys ah, investments will always carry risks but with property investment, YOU can do you own due diligence and YOU do not need to just simply rely on others. If you like to buy, then you check if there are people renting that area FIRST. One does not buy first and then only check out potential tenants AFTER. This is property investment.

There are a lot more bad properties nowadays

No idea what people meant when they said bad property. Cannot get tenant means bad property? Price falling means bad property? Developer ran away halfway is bad property? Cannot sell quickly is bad property? Haunted property is bad property? Overpriced property is bad property?

Just look back at the chart above showing around 140,000 property transactions. Means how many of these 140,000 properties are bad properties since there are a lot more bad properties nowadays? I would love to know since I do not know the actual number of bad properties which was mentioned.

Property investment is COMPULSORY

If all the financial planners are earning above the T20 household incomes per month and they could save / invest the money properly, they can afford to continue renting. Else, they better have at least one property because paying rental forever is a lot of money even if the rental stays the same at RM1,500 per month for the next 30 years.

Meanwhile for all other millennials who are not financial planners, just need to remember that property investment may not be the better or even the best investment but everyone needs a roof over their head. When one gets married, one needs a proper home. When one has a new baby, one needs a bigger home. When one gets a better job offer and needed to move to a new city, one needs a new place to stay. This is why property investment is compulsory.

This is why property investment is definitely not just for the older folks like me. I am 45 this year. So, not considered under the millennial category.

Property News Malaysia? Sign up for daily investment news updates (FREE since Nov 2013 and FOREVER). Alternatively, Follow me on Telegram here.

Please LIKE kopiandproperty.my FB page to get daily updates about the property market beyond kopiandproperty.my articles. Else, follow me on Twitter here.

Next suggested article: Property overhang in Malaysia. Johor is top

Leave a Reply