Economy and Property. 4 things about economic growth.

On 2nd March 2022, I gave a 40 minute sharing. Take a look at the above. My topic was about Economy and Property. Out of the 28 slides I presented, I think I will share 4 slides here to just look at the state of the Malaysian economy. We also look at things which could reveal to us what’s really happening in the market.

Yes, if the economy is growing, it will lead to people feeling more confident as they could get a decent job. This will then drive the demand for goods and services and in the very near future, property. People do not buy a property as soon as they feel confident. There’s a lagging factor, so if the economy is growing, probably the property transactions should show an uptrend one or two quarters later. Here are the 4 slides.

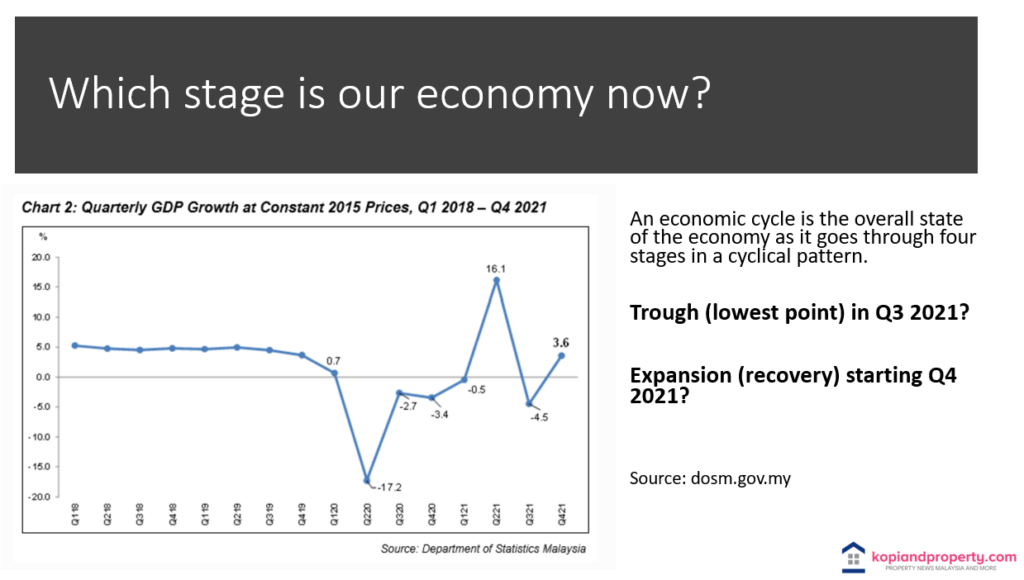

#1 – Which stage is our economy now?

If we have 2 quarters of negative growth, we have technical recession. If the full year is negative, we have a recession. Well, we experienced both from the numbers below. 4 quarters of negative growth in GDP from Q2 2020 all the way to Q1 2021. Due to the low case, Q2 2021 GDP suddenly shot up taller than a durian tree. 🙂

It is positive 3.6% in Q4 2021. In other words, we are not in a recession and we are also not in a technical recession. At the moment, it seems that the economy is growing… Bank Negara Malaysia is also supportive of this growth. This was what they did to the Overnight Policy Rate (OPR) on 3rd March 2022. (Read all about it here)

#2 – What are the predictions for GDP growth in 2022?

Well, depending on who we like to refer to, it ranges from 5.5% all the way to 6.5%. Let’s hope it’s on the higher side versus on the lower side. The predictions are as below. Just google for those articles and have a read on why they predicted those numbers yeah.

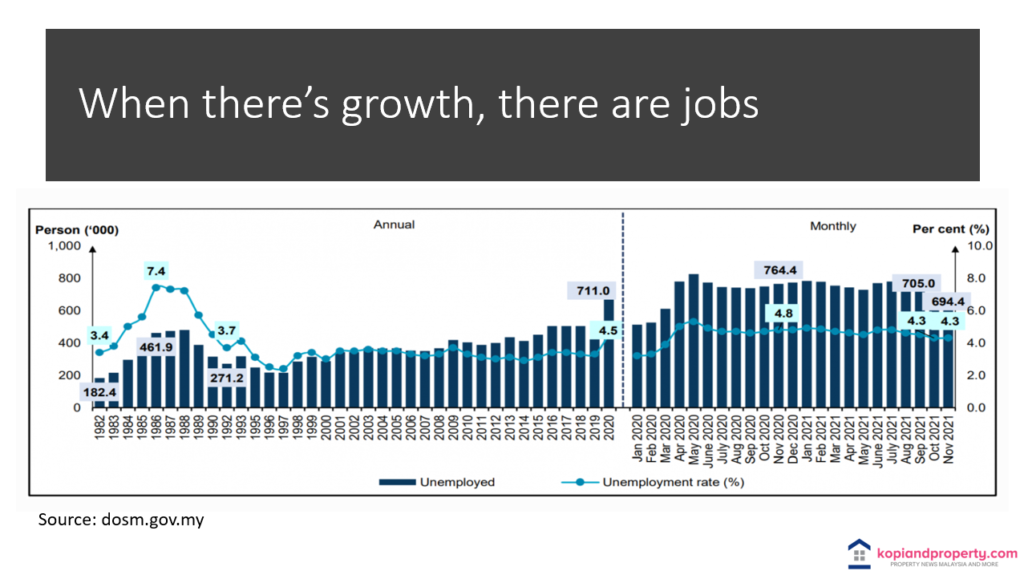

#3 – Let’s look at people without jobs; unemployment

As long as the number remain stable and showing a bias for a downtrend, we should be okay. I meant the unemployment numbers. We need to understand also that the demand for goods and services will come from the over 95% of the employed Malaysians and smaller demand from the unemployed. In other words, if there are confidence, these over 95% of Malaysians with a job will be the one driving the economic growth, not the ones without a job.

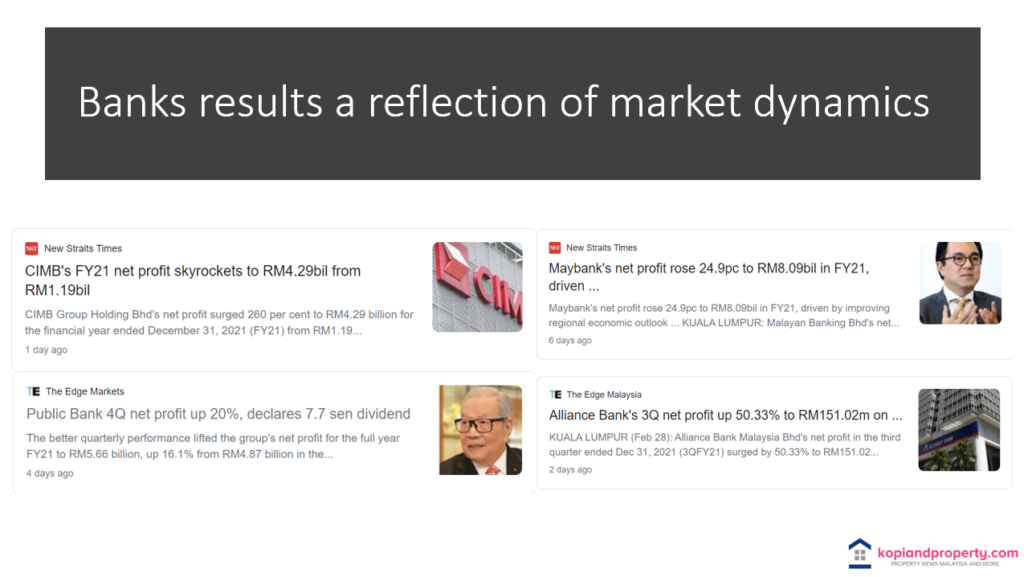

#4 – Banks’ results will reflect the market

If the market is truly bad, businesses will not borrow money. People would also not borrow money to buy properties. Thus, if we like to know if the market is moving, look at banks’ latest results. Just refer below and we can see generally, the numbers for 2021 is better than that of 2020. With moratorium ending end 2021, what do you think will happen to the banks’ profit numbers for 2022? Your guess is as good as mine. My guess is, their numbers will be even healthier than 2021. We will see.

Never believe anyone asking you to buy a property without looking at the economy

If someone were to ask us to buy a property, it’s good to ask them how’s the economy doing. If they could not answer, perhaps good for us to read a bit more. They may be selling a property to you because they wanted the commission. Well, if they wanted the commission, then they should read more and share more. Then, the buyer will feel more relieved with actual understanding of what’s happening with the economy. Buying blindly is not a clever thing to do no matter what is the state of the economy.

Property News Malaysia? Sign up for daily investment news updates (FREE since Nov 2013 and FOREVER). Alternatively, Follow me on Telegram here.

Please LIKE kopiandproperty.my FB page to get daily updates about the property market beyond kopiandproperty.my articles. Else, follow me on Twitter here.

Next suggested article: 5 Must-Do steps for property investment.

Leave a Reply