Worst and Best Time to buy a property?

History teaches us lessons only IF we really want to learn from it. This is also the reason why I always tell people that when it comes to property investment, learn from what has happened and not just hear rumours.

Malaysia property market is not as good as the Australian property market

One very good example? Too many people I know have told me that Malaysia property market is NOT as good as Australian property market. Frankly, I do not even wish to debate on which is better! Haha. Guys ah, in Melbourne or Sydney today, the median property price already tells us that majority of Australians would struggle to buy a property anywhere in or near city centres. They are buying suburbs and their suburbs are not 30km away yeah. It’s 60km away…

Learning means absorbing data and turning them into information for action

Please do learn what these trends from more advanced property markets are telling us yeah. Learn and take actions. I bought into Kelana Jaya when everyone was saying that only freehold is worth buying. When I sold that property, everyone suddenly realised they should have done the same. I bought into Sungai Ara (Penang) and many asked why not Gelugor? When I sold that property, they said they should have bought the same. I bought into a condo nearby cemetery in Tanjung Tokong and the price I paid versus today is a huge difference. I can tell more examples but it’s okay. Everyone has their own way of investing, so all the best to everyone.

May all of us be successful in our investments yeah. Now, coming back to timing. Best Time, Good Time, Better Time or even Worst Time?

1998: Best Time or Worst Time?

If someone were to invest during the worst time, say the 1998 ASEAN financial crisis, this person would have gained tremendously whether she bought into the stock marke or even the unit trust. Property prices dropped double digits in 1998 versus 1997 but in 1999, it rose by double digits too. If the person held those investments till recent years, the person could have enough to retire. In 1998 for example, a typical landed property in Penang is probably RM400,000?Imagine owning just 2 of them and compare the price then to today’s price…

The LUCKY ones who bought then would have been buying during the worst time and yet it was also the best time for them.

2008 – 2013: Best Time or Worst Time?

If someone were to buy a property during the booming years and she happened to buy towards the end of the booming years, then this person may need to have the power to hold. This is because after 2013, the property prices have not been the same as the 5 years before 2013. This meant that investing during good times, does not necessarily give good returns. Okay, unless that someone managed to invest into some undervalued properties even during good times.

Actually, no matter what is the time, property investment over 20 years for example, the total number is always up. So, perhaps we can do three things instead?

Learning from history and trends from developed property markets?

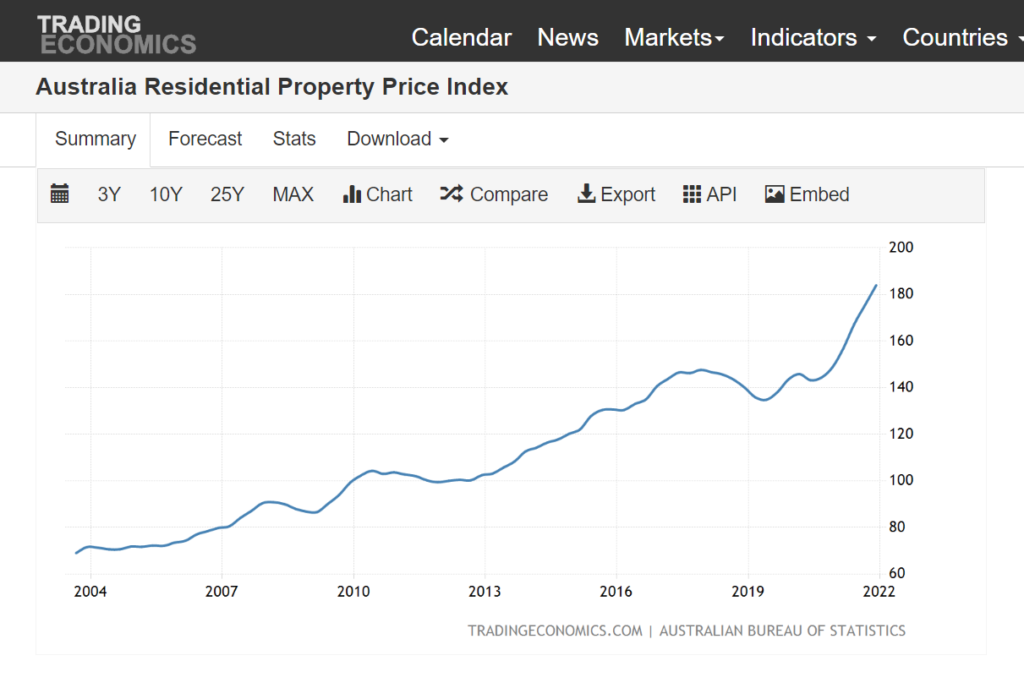

The above chart would tell you that as long as one bought a good property, hold it over the years, one would profit from selling it or at the very least hedge against inflation. By the way, hedging against inflation is a super important thing because if inflation is ONLY at 4% per year, we would lose half of our wealth within just 13 years yeah. Means, if we have RM1,000,000 the value will fall to just RM500,000 in 13 years if we did not hedge against inflation. Be very scared okay.

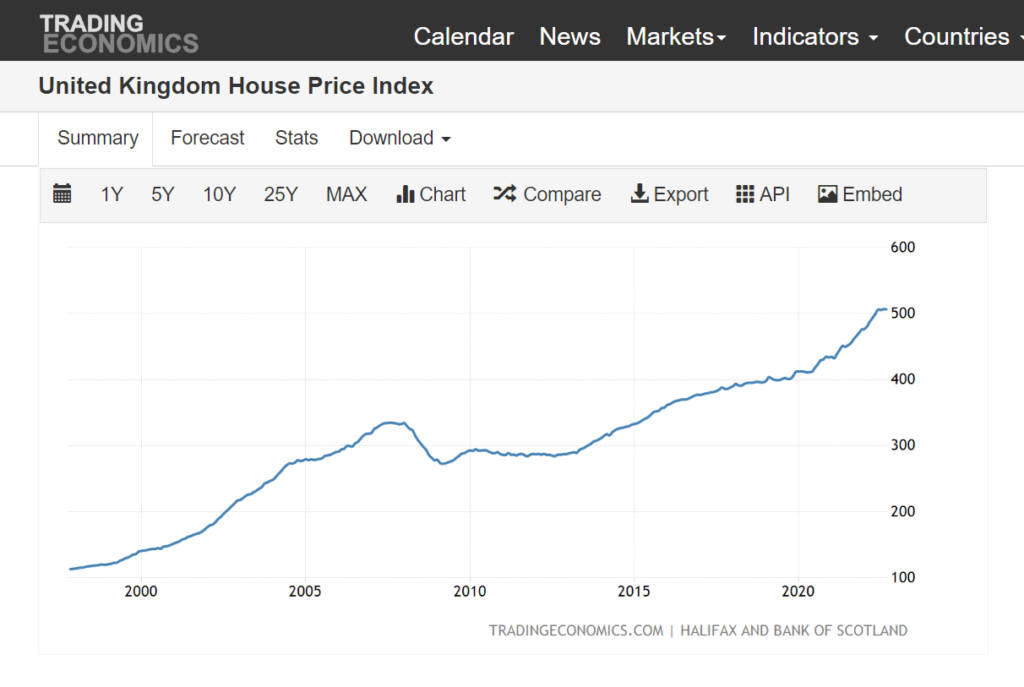

Now, let’s look at also the price trends from that advanced property market?

It’s the decision, not the timing

Happy understanding that there is no worst time or best time. It’s just the right property or the wrong one versus the okay price or overpriced. Learn enough to choose the right one and forget the timing. Learn enough to choose one which is not overpriced. Cheers.

Property News Malaysia? Sign up for daily investment news updates (FREE since Nov 2013 and FOREVER). Alternatively, Follow me on Telegram here.

Please LIKE kopiandproperty.my FB page to get daily updates about the property market beyond kopiandproperty.my articles. Else, follow me on Twitter here.

Next suggested article: It’s not an investment if we know nothing about it

Featured Header Image from https://www.pexels.com/photo/interior-of-kitchen-with-modern-furniture-6301168/

Leave a Reply