Get ready to LOSE a lot of our money because of inflation

Inflation effect is real

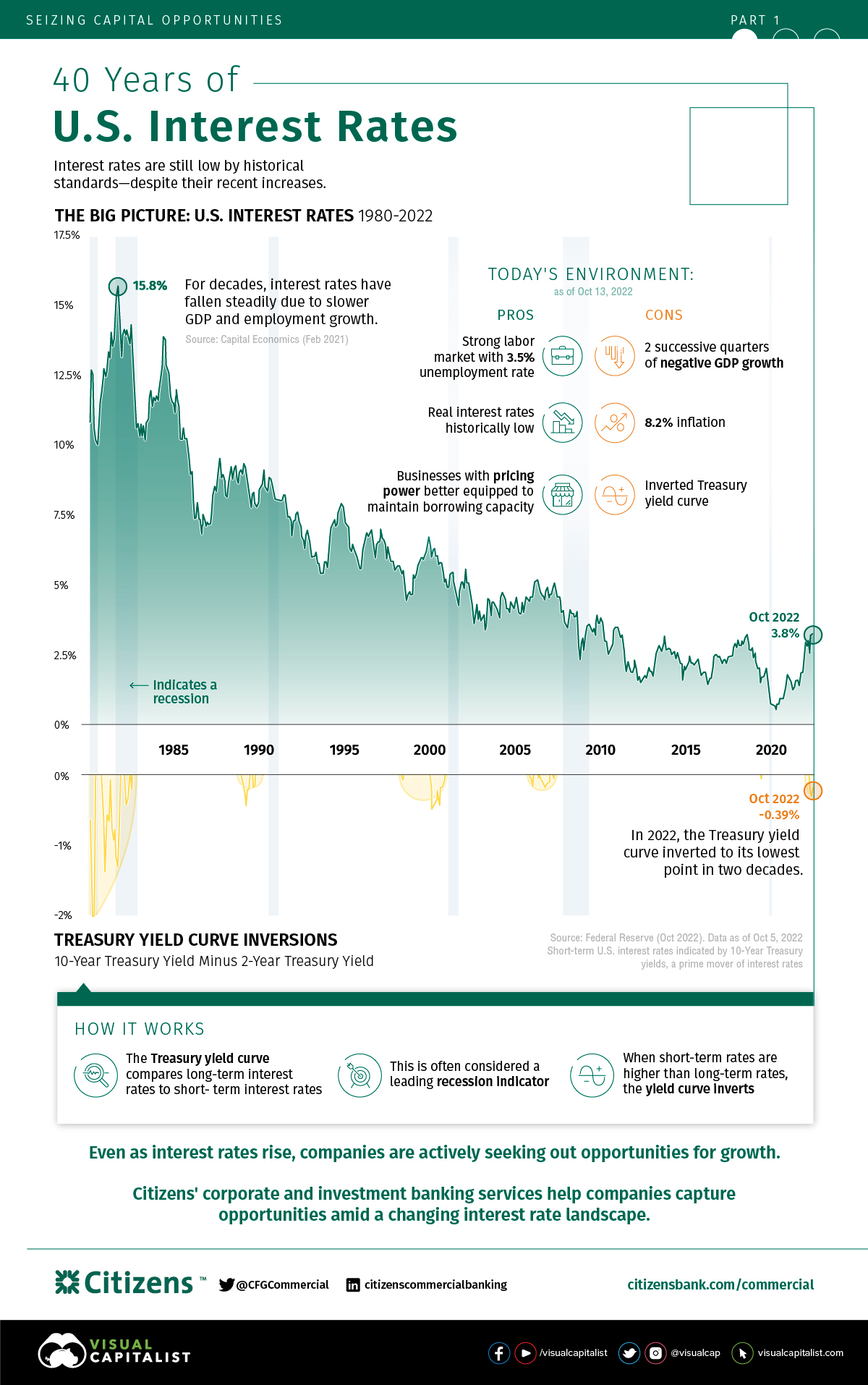

Recently, it has been revealed that many developed countries are suffering from double digit inflation and that’s one major reason why they kept increasing their interest rates in order to tame inflation. One example is the U.S. The interest rates have been raised to the most current 3.8% from an average of 0.9% in 2020. It’s 4x higher versus that starting point. With all these expectations, the US$ continued to chalk new highs versus all major currencies except those which is pegged or linked to it.

Why must interest rate be raised to tame inflation?

When rates are raised, there’s a higher chance that people would prefer to keep their money in the bank, stop speculative buying which would then tame the inflation as the demand for goods and services slow down and the prices will not keep getting higher; inflation.

The reason why central banks kept raising rates is because the above was not yet working and people continue to spend their money excessively. I hope they the U.S would stop soon because many home owners with loans / mortgages would be struggling to pay their repayments if the rates kept rising. In fact, people may think buying a home is just too expensive unless the home owner reduces their selling price instead.

Is raising interest rate working?

Well, if it works very well, then it is supposed to slow down the price increase or even cause the price to drop. The reason is because there are less demand for goods and services and even properties. So, the very least is that inflation will slow down tremendously and prices are supposed to stop rising too. However, this may be a double whammy for property owners yeah. Why is that so?

Interest rates up meant that the monthly mortgage is up. Homeowners must pay more. However, they may not be able to sell their home at a higher price because many people do not want to buy because the interest rate is inching higher. They are worried that if they buy now, what if the rates kept rising?

Low interest rates is also not good too

When rates are low, everyone thought it is cheaper to buy. Ahem… when everyone thinks the same, then everyone would buy more. That’s the start of a speculative bubble and in fact this will always be one potential bubble. Another reason it is not good is for depositors of fixed deposits. The rates they earn will be so low that it may not be enough for them in the future since inflation may still be higher than the returns from the fixed deposit.

This is why investment is really a must

Without investing our hard earned money, there is no way our hard earned money could work harder to earn us more money. Keeping it as fixed deposit is still better than putting the money under the bed yeah. Meanwhile property is the only investment which will rise with inflation. Cost of materials go up, cost of land goes up, cost of labour goes up and this would meant that the prices today could not be maintained for tomorrow. This is why property is said to be a hedge against inflation.

Happy understanding.

Property News Malaysia? Sign up for daily investment news updates (FREE since Nov 2013 and FOREVER). Alternatively, Follow me on Telegram here.

Please LIKE kopiandproperty.my FB page to get daily updates about the property market beyond kopiandproperty.my articles. Else, follow me on Twitter here.

Next suggested article: It’s not an investment if we know nothing about it

Leave a Reply