EPF? Withdraw RM10,000 today is equal to RM100,000 or more when we retire

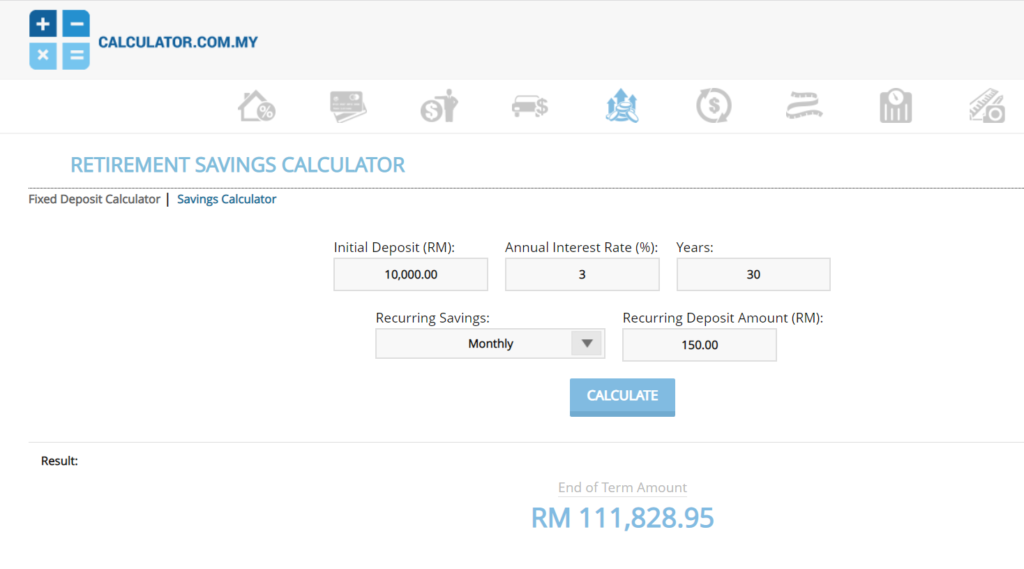

Will not say too much. Let’s see numbers instead. Just look at what happens below where if we have RM10,000 today and the EPF contribution is just an extra RM150 per month. What will happen to the amount of money we have at the end of 30 years? With just a typical return of 3% per year? By the way in 2021, our returns were… 6.1% (Read here for full article)

Article in nst.com.my PM announces special RM10,000 EPF withdrawal for Keluarga Malaysia. Prime Minister Datuk Seri Ismail Sabri Yaakob in a special press conference today said the amount is set at RM10,000. He also said that the details on the withdrawal will be announced by the Finance Ministry and EPF. Article in nst.com.my

EPF is really for retirement a.k.a last resort

Withdrawing RM10,000 is easy. It’s even officially allowed already as announced. Saving back the withdrawn amount of RM10,000? Now, that’s a long road home. It will take a very long time. What if we could save RM200 per month? It will take more than 4 years just to have back this RM10,000. What if we could save RM100 per month? It will take over 8 years! We have not yet calculated the amount of dividends which we have lost.

Please think very carefully and not withdraw the money because it’s allowed now and you like to use the money to buy the latest smartphone yeah. There is a huge difference between Need versus Want. Thank you.

Property News Malaysia? Sign up for daily investment news updates (FREE since Nov 2013 and FOREVER). Alternatively, Follow me on Telegram here.

Please LIKE kopiandproperty.my FB page to get daily updates about the property market beyond kopiandproperty.my articles. Else, follow me on Twitter here.

Next suggested article: 3 other forced savings beyond EPF

Leave a Reply