Personal Finance 101: Why do banks offer moratorium?

Moratorium was first offered during the Covid-19 lockdowns

In 2020, Bank Negara Malaysia announced a 6 months AUTOMATIC moratorium to all bank loans — except for credit card balances. Article in nst.com.my here.

In 2021, another round of 6 months moratorium was offered to all individuals, microenterprises and affected SMEs starting from 7 July 2021. This was announced by Bank Negara Malaysia here: https://www.bnm.gov.my/-/six-mth-mora-begins-20210707

Briefly, moratorium means that the banks will allow their borrowers to stop paying for the monthly instalments until the end of the moratorium period. If every month the monthly mortgage is RM1,500 it means that the person will save RM1,500 x 6 months = RM9,000. This amount is hoped to be able to help the person with his expenses because there is a chance that the person had lost their source of income due to Covid-19, especially due to lockdowns where economic activity trickles down to a minimum.

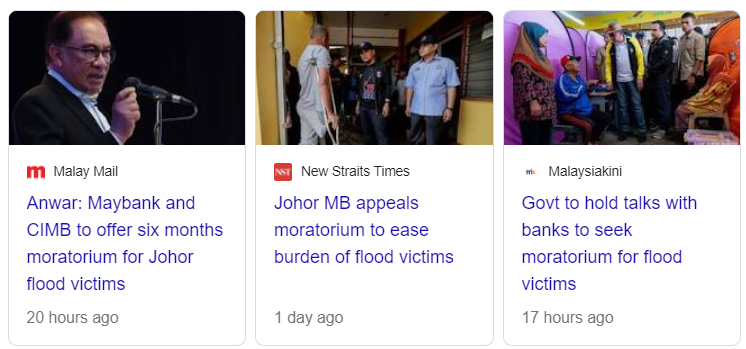

Here are the latest news on moratorium from our friendly google

One says Maybank and CIMB offering six months moratorium to Johor flood victims. Bank Pertanian has also just joined this list too. Another tells of how Johor MB appeaking for moratorium so that burden on flood victims could be reduced. Meanwhile the last one says that the government is holding talks with banks on moratorium for flood victims. Suffice to say that since the news are all quite recent, it meant that more banks are likely to join the current three banks in offering moratorium to Johor flood victims.

What is moratorium’s meaning?

Investopedia offers a definition from the investment perspective. “A moratorium is a temporary suspension of an activity or law until future consideration warrants lifting the suspension, such as if and when the issues that led to moratorium have been resolved. A moratorium may be imposed by a government, by regulators, or by a business.” Read it here. https://www.investopedia.com/terms/m/moratorium.asp

Briefly, it’s a stop in loan payment for a period of time in response to some financial hardships.

Why banks may prefer moratorium versus usual loan recovery steps?

If we lent someone money to buy a property, we would want that someone to pay us every month. Now imagine this someone loses his job and thus lost his income and thus unable to pay us what he owes us. We could send him a letter to remind, we could then proceed to even auction off the property if the person did not start repaying by a stipulated time.

Now… what will happen when we auction off a property during a Covid-19 lockdown? Would the property be sold at a higher price or a lower price? Chances are the property price may be sold at an even lower price that the remaining amount being owed by the owner. In other words, the bank would not just have to pay many parties for this process, they would also have to write off some of the amount owed as bad debts.

Now, if the bank chose to offer a moratorium for 6 months. There is a chance that majority of those who lost their job could find another job maybe 1-2 months later. The person would then start repaying and the bank would continue to have an uniterrupted continuation of earning the interest from the home loan. There are no expenses to be paid to auction the property. There are also no potential bad debts too.

Breathing space from moratorium beneficial to all parties

For the person / business, this moratorium provides a breathing space. They also do not want to face the prospect of being a bankrupt too should they fail to repay the loans to the banks. Thus, both the bank and the person / business would gain from this breathing space to get everything back in order. Just need to note that the banks must be strong financially in order to allow for this. If we force a weak bank to do so, then the bank shareholders would now have to start worrying!

Hope this explains in laymen term why moratorium is a good way to move forward, at least for a short period of time.

Property News Malaysia? Sign up for daily investment news updates (FREE since Nov 2013 and FOREVER). Alternatively, Follow me on Telegram here.

Please LIKE kopiandproperty.my FB page to get daily updates about the property market beyond kopiandproperty.my articles. Else, follow me on Twitter here.

Next suggested article: It’s not an investment if we know nothing about it

Leave a Reply