Do not become a mortgage slave. Not now, not yet.

Who is known as a mortgage slave?

Anyone who has a home loan, is the person considered one? Mortgage slave’s definition as per wikipedia is as follows: Mortgage slave is a term used for homeowners in China who spend more than 70% of their disposable income towards repaying loans. Click here to read in full if you like.

If you ask me, instead of 70% as per the above definition, I personally think as long as anyone spends above 50% of their disposable income on a property, they can be considered a mortgage slave. The reason is a simple one. With over 50% of disposable income being used for mortgage, even if the manager / boss has a bad attitude towards the person who’s a mortgage slave, this person would have no choice but to continue working…

Else, how to keep up with the home mortgage if one were to resign without a new job paying at least the same or higher salary?! Anyway, below are 4 reasons why first time home buyers still have a choice and may not need to be a mortgage slave in Malaysia. Not now, not yet. There is really no need to overstretch financially no matter how much we are earning currently.

#1 Plenty of affordable choices still

We are not like a country where the only slightly more affordable property seems to be a unit as small as a car park size. We are also not a country where the people wait for their government to build them really affordable homes and they have to be limited in the flexibility to sell it for a big profit in the future even if the price have doubled after 15 years.

We are in Malaysia. If we need a place which is 15km from KL city centre (KLCC for example), the never-ending choices range from Jinjang to Mont Kiara, Sentul to Batu Caves, Wangsa Maju to Cheras to Damansara Uptown and so forth… (not all are affordable yeah) Plus, if we are looking at townships (whether newer or older), the choices are now aplenty; from Rawang to Semenyih and Nilai or even Banting.

Alternatively, just go to any property listing site in Malaysia and search for properties below RM300,000 and the choices remain aplenty. Developers are also doing their best to build all these RM300,000 properties these days. Thus, choices are available. It may just not be the type of property or the area we love, that’s all. Perhaps time to be more objective before having to become a mortgage slave?

Let’s face it, we only need to spend a little more time to search, and not just settle for the first ‘perfect’ deal we come across. Not only do we have the luxury of choice, but also the online tools to make our search quicker and easier.

#2 – Just because we COULD afford does not mean it’s a buy

I do think the maximum we should ever spend for a home instalment is 50% of the monthly net income. However, just because we could does not mean we should. If we could afford up to RM2,000 monthly mortgage and we bought a home requiring RM1,500 we would be able to save RM500 every month which could have been used for electricity… petrol… etc. Alternatively, RM500 savings inside the bank would yield the person RM6,000 after one year!

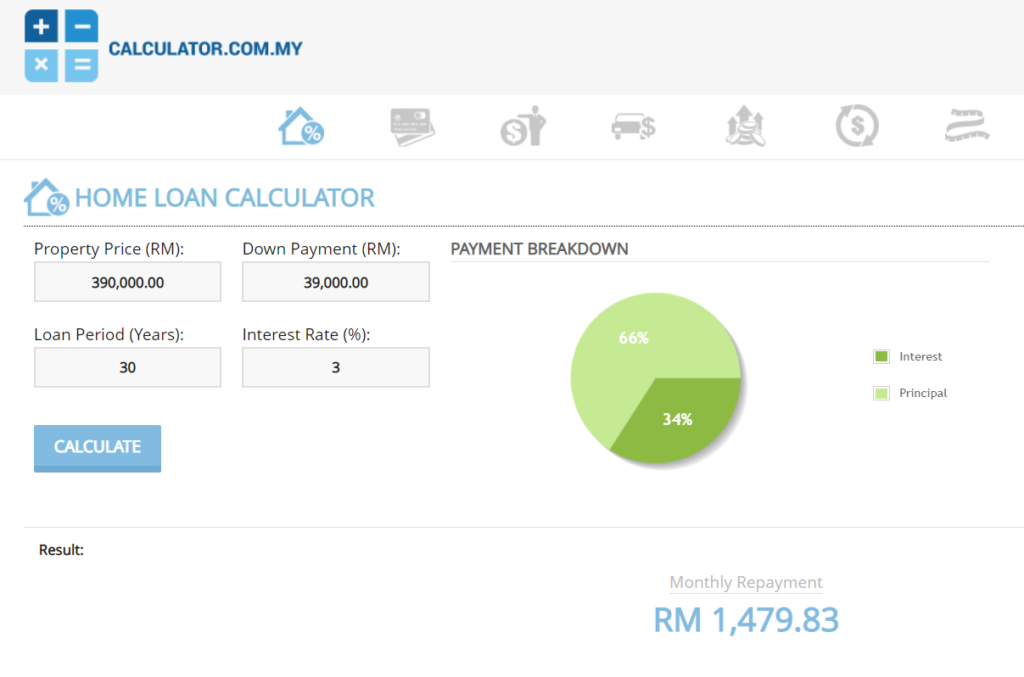

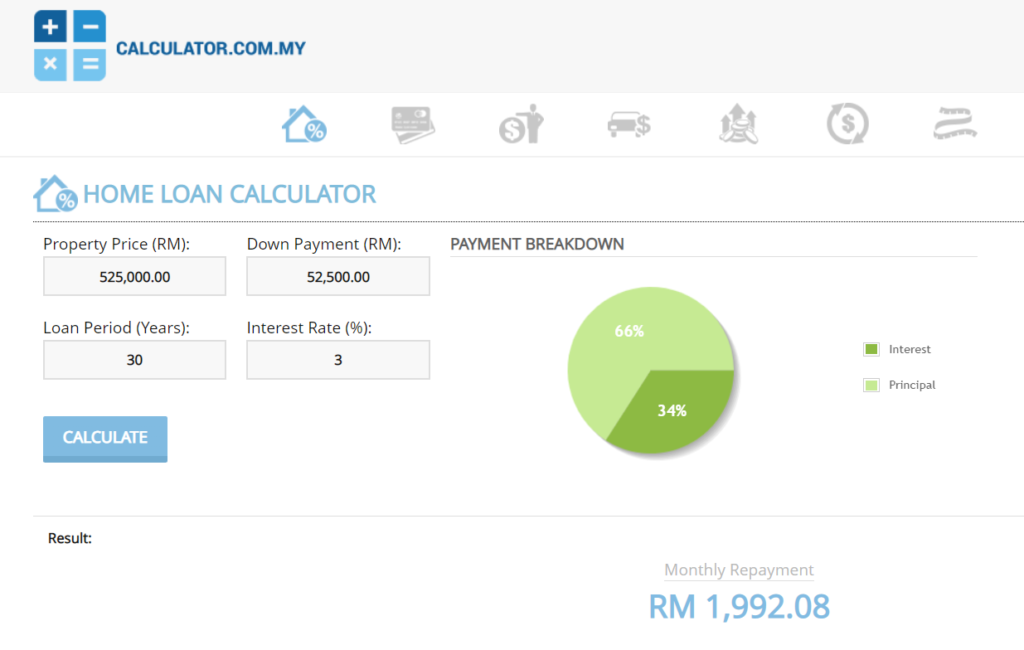

What’s the difference in property price for RM2,000 vs RM1,500 instalment? Do refer to the two charts below. The difference in property price is RM390,000 (monthly instalment of RM1,500) versus RM525,000 (monthly instalment of RM2,000). In actual amount, one could buy a RM525,000 property or save RM500 per month and buy a RM390,000 property instead.

#3 That dream home today is not the dream home tomorrow

Every time we are asked what’s our dream home, we could either give an answer which we could not afford or an option we could barely afford; stretched financially. Frankly speaking, after having bought and moved homes 4 times (730 sq ft apartment, 1,258 sq ft condo, 1053 sq ft condo, 1,743 sq ft condo), I can share from my experience that the dream home today may not be the dream home tomorrow. This year (end 2022) I will be getting the key to my next dream home and will move again next year. (early 2023)

This is why when we buy below what we could afford, we are killing two birds with one stone; have a roof over our head (even if that’s not our dream home) plus savings which we could use for any other purpose. Here’s an earlier article about our DREAM HOME. Of course the other purposes, hopefully it’s for wealth building purposes yeah.

The ‘best home’ status of any new purchase is only for the moment. As our income continues to grow, we will move from B40 to M40 and even T20. (Household Income classification) By then, would this home still be the ‘BEST’? Of course not!

#4 What if a good investment opportunity comes along?

Cash is king. Frankly speaking, the best opportunities come during a slowdown and these opportunities will only be open to those with cash to spare. If we were to have invested all we have into one home (the highest price we could afford), and are using up most of our monthly salary for repayments, bills, and necessities – there wouldn’t be any (or enough) extra cash for that sudden opportunity.

In the business world, even the best companies keep reserves because they know that they may need it sometime in the future. Most bluechip companies have reserve funds for that potential opportunity that may appear during bad times.

Conclusion?

We still have property choices at the moment. We still get to choose whether or not we like to become a mortgage slave. I am not sure if one day there are no longer any affordable property choices. Perhaps that day may come. Just need to remember that buying will always be better than renting.

Yes, I know that renting a place for RM1,500 is likely to give us a comfortable place which is more expensive than RM400,000. It’s a question of losing the full RM1,500 or adjusting ourselves to a home which we could afford at RM1,500 mortgage per month.

Keep researching, keep saving and keep investing. That’s the best advice we should always keep in mind.

Property News Malaysia? Sign up for daily investment news updates (FREE since Nov 2013 and FOREVER). Alternatively, Follow me on Telegram here.

Please LIKE kopiandproperty.my FB page to get daily updates about the property market beyond kopiandproperty.my articles. Else, follow me on Twitter here.

Next suggested article: If we could do better than the EPF, should proceed to do so

Leave a Reply