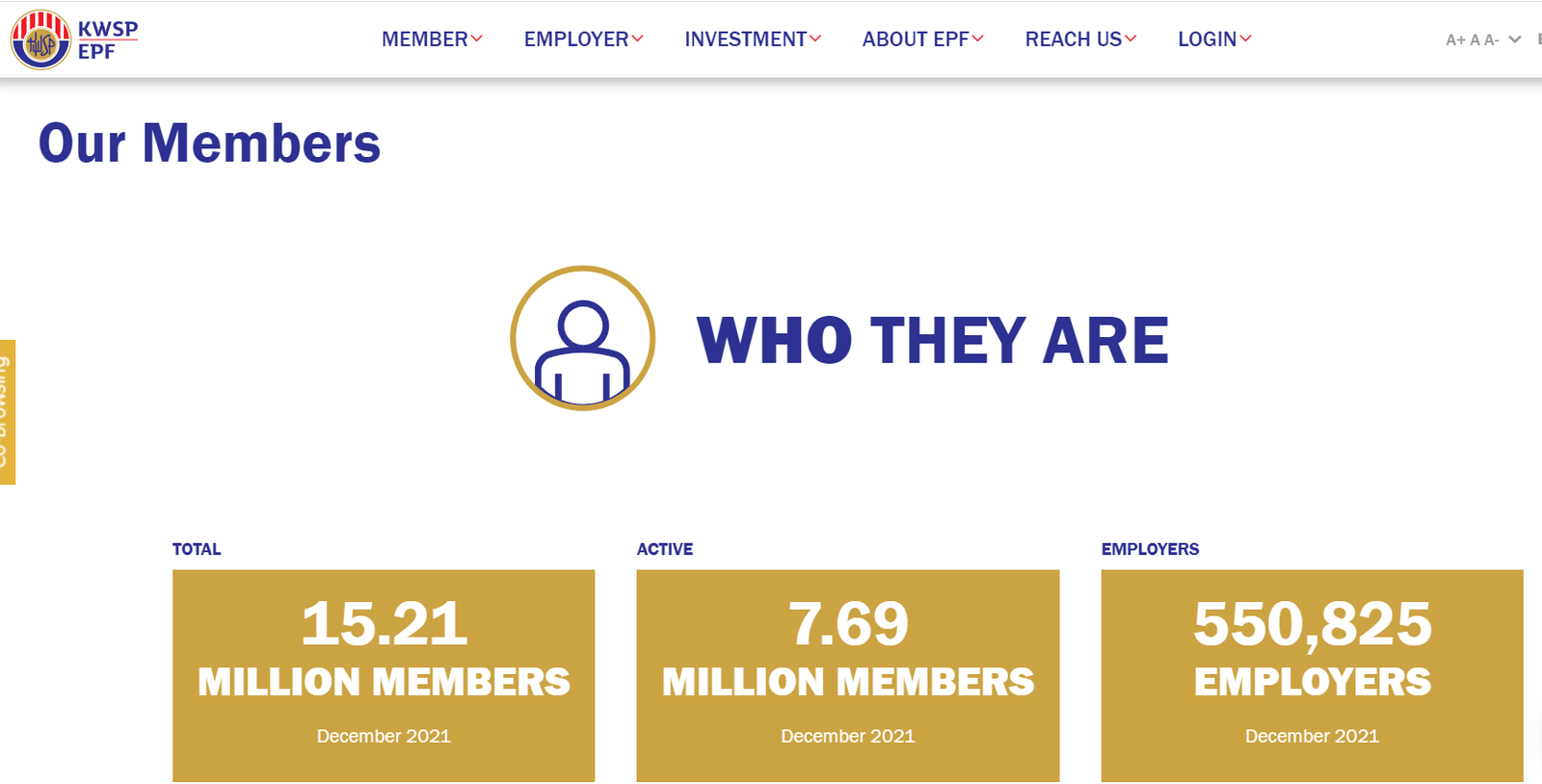

RM240,000 is the minimum we need to have in EPF when we retire

Withdraw EPF savings before 55?

If this is a question for me, “Should I withdraw my EPF before 55?” My answer is a simple one, NO. My main reason is because EPF savings is really for post-retirement, when our active income has stopped or has gone down significantly versus the time when one was still working full time and thus has monthly income. In fact, I would like to leave the savings in EPF inside EPF as long as possible so that I have something to fall back upon.

At the same time, I would ‘FORCE’ myself to do three extra things so that I actually have money to spend and can leave EPF as my last resort to dip in. Before that, let’s see the reason why EPF says that RM240,000 is the minimum. Click here to read what EPF said.

Why RM240,000 should be the minimum?

If we assume we retire at 55, then we need to be ready with funds to live by for the next 20 years. I assume life expectancy to be 75. It’s higher by the way if we look at the average life expectancy for Malaysians. The RM240,000 meant that the member would have RM12,000 per year or RM1,000 per month. This is RM240,000 divided by 20 years until we say bye-bye to the world. Some would say that this is barely enough today, how could it be enough in the future? This is why EPF savings must not be the only savings. Let’s look at 3 other FORCED savings we could do too.

#1 – Forced saving in the form of a property monthly repayment

When we rent, no matter how high or low or how worthy because the rental is lower than mortgage, at the end of the day, whatever amount we paid for rental does not belong to us. I do not have any friends who gave returns to their tenants because their tenant has paid them 20 years of rental without any delays. I am also not going to allow my tenant to stay for free after their income has stopped or when they retire just because they have rented from me for the past 30 years.

I forced myself to start paying for my first property when I was 25 years old. The first 4 years of working, I paid rental. I pay them on time too. I am happy I forced myself to buy that property because if I did not, the for the past 24 years of working life, I could have paid the following amount in rental. I assume the rental I paid for that one apartment remains unchanged since the first day I stayed there yeah.

RM550 x 12 months x 24 years = RM158,400. Fortunately, I bought that first apartment and sold it many years later for a surplus of RM100,000 over the price I purchased.

#2 – Forced savings means staying grounded

There is little need to force people to think highly of us simply because of what car we drive or what watch we wear. I just remembered that my Persona is in the 12th year now. I finished paying for it 7 years ago. In other words, I have saved RM600 per month x 7 years and that’s a substantial RM50,400. This is also a ‘forced’ saving because for the past 12 years, many people would have seen my Persona and thought, ‘oh dear he’s poor and could not afford a Japanese branded car.’ It’s okay. I prefer RM50,400 versus having my peers thinking positive of me. Anyway, no matter what car I drive, there are still so many people drive better cars yeah. Haha.

#3 – Forced savings means focus on needs and not wants

There’s also the ‘forced’ saving from not buying unnecessary stuffs during 1.1, 2.2, 3.3 up until 12.12 sale. My good friend whom I always learn a lot when we meet, Suraya of the famous ringgitohringgit.com shared with me before that when she wanted to buy something, she will delay the decision for a while. If she could survive without it, then the item is actually not necessary. What an amazing way to decide whether it’s a need or actually just a want.

Yes, I think everyone should read her personal finance blog yeah. RinggitohRinggit.com. I have also done something similar. I just delay that purchase for one month. If I could not, then it’s really needed. Else, it’s okay not to get it.

That RM240,000 is definitely not enough yeah

This is why it’s best to do extra through forced savings yeah. I do hope my little sharing could help everyone rethink about their financial status today and manage it a little better. By the way, I am not that amazing in saving every ringgit and sen also lah. I have my own interests too. I have over 30 pairs of shoes… Image below shoes just my brown coloured leather shoes. I have over 15 formal jackets. I have over 70 long sleeve shirts of different colours and designs. I better stop here… The reason I could have all these? Easy lah. Forced savings when needed.

Property News Malaysia? Sign up for daily investment news updates (FREE since Nov 2013 and FOREVER). Alternatively, Follow me on Telegram here.

Please LIKE kopiandproperty.my FB page to get daily updates about the property market beyond kopiandproperty.my articles. Else, follow me on Twitter here.

Next suggested article: Outlook for the property market 2022

Header image source: https://www.kwsp.gov.my/en/member/overview

Leave a Reply