Why buy property? Better save RM1 million instead

Inflation is real: RM50 today is smaller than yesterday

Surely everyone would have heard of RM50 10 years ago is more than RM50 today and RM50 10 years later will be lesser than RM50 today. Then they used a trolley to show that last time can buy while trolley and now can only buy a small trolley. I am very sure they are right. Question is, the ones who shared all those, are they also doing something about it? At least to counter the effects of inflation?

This is the same as property price. RM500,000 today may just be equivalent to RM300,000 10 years ago, maybe. RM800,000 10 years later may just be RM500,000 today.

Think and decide about that RM500,000 savings

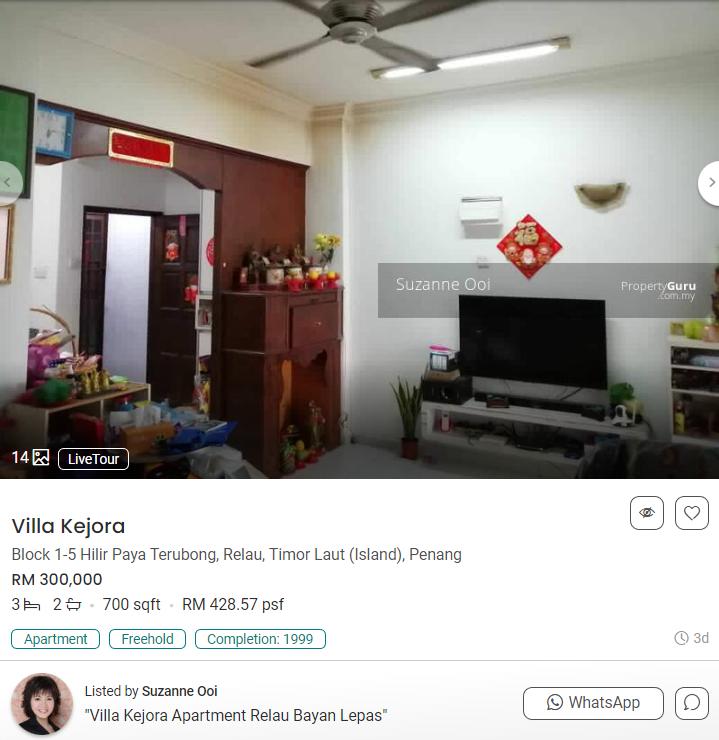

In 2003, I bought my first property, an apartment for RM123,000. I sold it for RM238,000 many years later. I checked and the price is closer to RM300,000 today. When inflation continue to push up prices of everything, the price would continue to rise.

Could we save instead of buying a property then?

My question is a simple one. Could you save RM200,000 during that 10 years that property prices rose from RM300,000 to RM500,000?

If you could, then do not buy property lah. Save the time, effort. Just save up the money.

It’s the same question to those who say RM1,000,000 in the future is just like RM500,000 today. Could you save RM500,000 from now till that time when RM1,000,000 value drops to RM500,000?

If you could, then forget property investment yeah.

Why need RM500,000 or even RM1,000,000?

Malaysians may live to 75 or even 80. Life expectancy is going higher because of access to better healthcare etc. We retire at 60, assuming we are so healthy and the company wants us to continue until 60. Before 60, because we have a job, we can pay rental if we did not own a property. After 60… when salary stops… we STILL HAVE to pay rental yeah. At 60, do we still want to stay in a room versus a small place instead?

Rental for a small apartment – RM2,000. (At that time, this RM2,000 is more like RM1,200 of today…)

60 to 75 years old is 15 years and 15 years x 12 months is a total of 180 months.

180 months x RM2,000 is RM360,000. By the way, this is just for the rental and this also assumes that your owner is a very nice person and does not increase the rental at all for the next 15 years.

So, if we have RM500,000 then we can spend up to RM140,000 for food. (RM500,000 minus RM360,000 for rental)

How much is RM140,000 for 15 years? That’s RM25 per day… Oops…

No wonder I put RM1,000,000 right? Haha. Yea, with RM1,000,000 then after deducting RM360,000 for rental (which is very very conservative), one would have RM640,000 for food and whatever other things which you like to do.

Perhaps RM80 per day for meals? (by then this RM80 is probably just RM50?) It will thus be RM80 x 365 x 15 years = RM438,000. If this is deducted from the remaining RM640,000 then we roughly have RM200,000 for us to do some travelling and even some other activities.

RM200,000 is an extra RM1,111 per month. So, save a few months and one can travel to some local destinations and if necessary, do one ASEAN trip every year?

Yes, this is why we need to save up RM1,000,000 if we do not wish to own at least one property.

Happy understanding.

Property News Malaysia? Sign up for daily investment news updates (FREE since Nov 2013 and FOREVER). Alternatively, Follow me on Telegram here.

Please LIKE kopiandproperty.my FB page to get daily updates about the property market beyond kopiandproperty.my articles. Else, follow me on Twitter here.

Next suggested article: It’s not an investment if we know nothing about it

Leave a Reply