There’s a famous line,”in this world nothing can be said to be certain, except death and taxes.” According to freakonomics, this was a line from Benjamin Franklin’s letter. Malaysians may be bracing for some, at least when the Budget 2019 speech is delivered this Friday (2nd Nov 2018) by our Finance Minister Lim Guan Eng. What are some of the taxes that Malaysians think will be coming for the new financial year? Here’s one survey result from Edgeprop.my from 2,463 respondents. Please read the article here. Respondents in the survey mainly come from those with an annual income of below RM60,000 (35.8%), followed by those earning from RM61,000 to RM120,000 per year (32.2%), from RM121,000 to RM200,000 (16.1%), and from RM201,000 to RM480,000 (10.9%). The remainder 5% are made up of those with annual incomes of RM481,000 to RM600,000, and above RM600,000. (Does not seem like the B40 group to me)

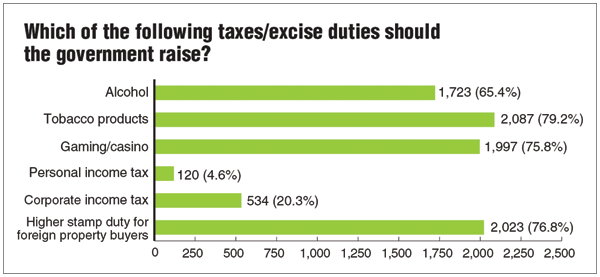

In brief, over half or 56.9% of respondents said the government should NOT raise tax revenue to pare down national debts. However, when asked if it is coming, what would be the taxes that the government should raise, the answers are as follows:

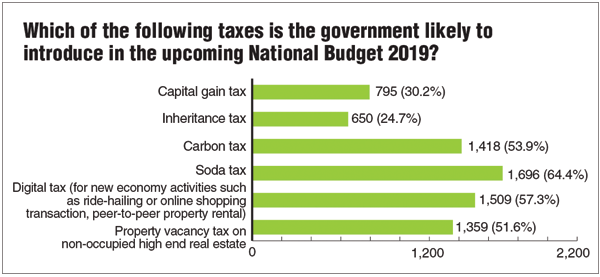

76.8% said there should be higher stamp duty for foreign property buyers. As for what are some of the taxes that may be introduced the answers are as follows: 64.4% think soda tax will be introduced, followed by digital tax (defined as tax on new economic activities like ride-hailing or online shoping transactions and peer-to-peer property rental) at 57.3%, carbon tax at 53.9%, and property vacancy tax on non-occupied high-end real estate at 51.6%.

Trailing low on the list is capital gains tax at 30.2% and inheritance tax at 24.7%.

Please refer to the full Article in EdgeProp.my Personally, I am on GST’s side for its flexibility; redistribution of the collection. I note on its weaknesses as per so many analysts and believe it could have been rectified instead or being replaced. Well, one thing is for sure, every government in the world would always need tax revenue. If one source is giving them lesser, they would have to find a new source. This adjustment hopefully will be one off and Malaysians could then focus on earning more money (government to facilitate expansion of the economy) instead of paying higher taxes. Happy following. Remember, taxes do not usually kill us. Inaction is that culprit…

written on 1 Nov 2018

Next suggested article: When we are living longer, we need to prepare more

Leave a Reply