Property Investment 101: Property price will drop when we have many affordable properties, right?

That question on property price

“Charles, we have too many affordable apartments being built today. This will soon collapse the market.” I still remember this statement from a friend (not a good friend, not a close friend, just a friend) many years ago. Well it was before Covid’s arrival. It was at a time when every developer were telling the world that their affordable project is the best affordable one. Somehow, it scared my friend who thought that property price will collapse when there are too many affordable apartments being built.

Dilemma for me too

By the way, I am an owner. I hope prices continue rising. I am also a potential buyer. I also hope prices would drop so that I could buy more. What a dilemma, right? This is why I smile when property developers issue press releases saying that property prices will rise and I also smile when there are good opportunities appearing because of the current market circumstances. You see, I love to smile. Haha. If only property investment could take the easy way; following the inflation. If inflation stays flat, property price should stay flat and so on. Somehow, some owners want property prices to rise as if there’s no tomorrow. Somehow some potential buyers hope property prices would drop to a level they think they want to buy. When asked what’s the price they want to buy, most do not have an answer…

What if hundreds of thousands of affordable homes were built?

Anyway, there are ALWAYS announcements about many thousands of new affordable homes or even hundreds of thousands of new affordable units when we stretch over a few years which will be built here in the Klang Valley. We have a huge population growth due to migration from smaller towns here in Malaysia. Let’s see whether the prices will be affected should there be hundreds or thousands or even tens of thousands of units being built yeah. Just 4 easy questions in fact.

#1 Are the target markets the same?

For product A to impact product B’s pricing, then product A would have to appeal to buyers of Product B as well. Else, no one who loves Product B would even look at Product A and vice-versa. I have never seen anyone looking to buy a new Volvo XC40 be affected by the pricing of a Perodua Ativa. At the same time, a buyer of Perodua Ativa is not going to be impacted too much no matter what special gift or discount which a Volvo XC40 would be providing because one Volvo XC40 is equivalent to around 7 Perodua Ativas!

When there is competition, then there will be a pressure on pricing. Coming back to property. There are certainly differences between these simple and new flats versus the many apartments priced from RM400k and has facilities. There’s also a difference between condominiums in popular areas versus further away ones. They are unlikely to be appeal to the same group of buyers.

#2 Are there really people buying properties today? I thought it’s already super quiet!

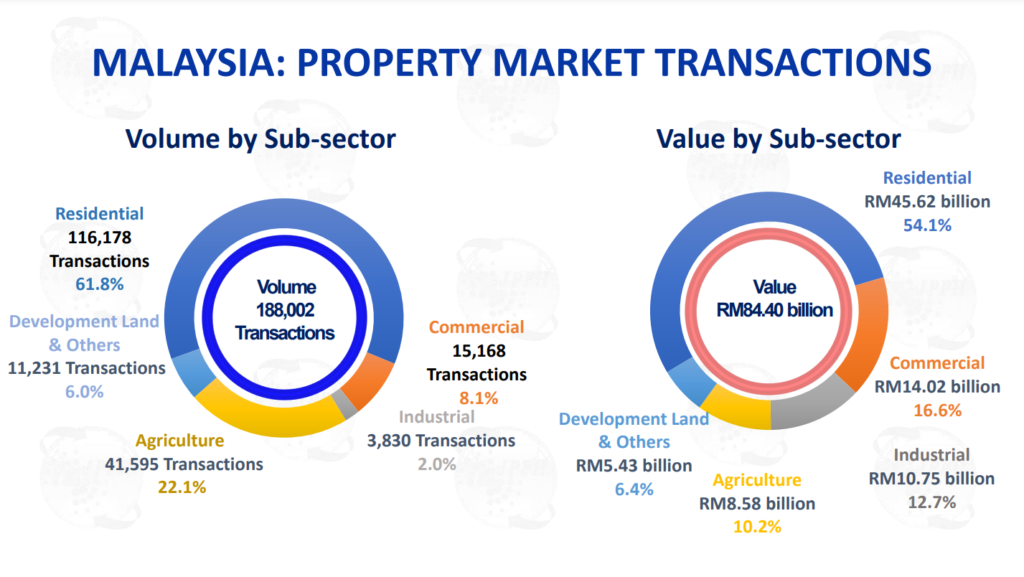

Let’s not debate on this one. Some would say it’s very bad (those who has yet to buy and does not wish to buy). Some would say that it’s super good and better buy fast. (Those with REN tags trying to sell you a property). National Property Information Centre (NAPIC) has the below latest H1 2022 total transactions numbers.

Just first half of the year, we had 116,178 residential property transactions. Period.

#3 Are there still people renting? (This means there is demand for property lah)

This one quite easy to see yeah. Ask all your new colleagues who has just joined if they are renting or paying mortgage. Many of them are renting. Most of the time, when people come to the Klang Valley to work, they do not immediately buy a place. They rent first. Whether they buy a place few years down the road or not, they will still need a place to stay and this is real demand for property.

Oh yeah, courtesy reminder to all who are renting. Assuming one is renting just one room for RM600 per month, that’s RM7,200 per year or RM72,000 for 10 years. RM72,000 is enough for 10% downpayment for any property priced all the way to RM720,000.

Meanwhile, if one were to rent one whole unit to have privacy, they may be paying RM1,500 for a small unit. That’s RM18,000 per year or RM180,000 per 10 years. This amount ‘lost’ to the homeowner could have been a downpayment for a new home and also buy a new Perodua / Proton with cash. Yeah, that’s why I am against renting unless one really earns way above everyone else.

#4 What about short-term demand?

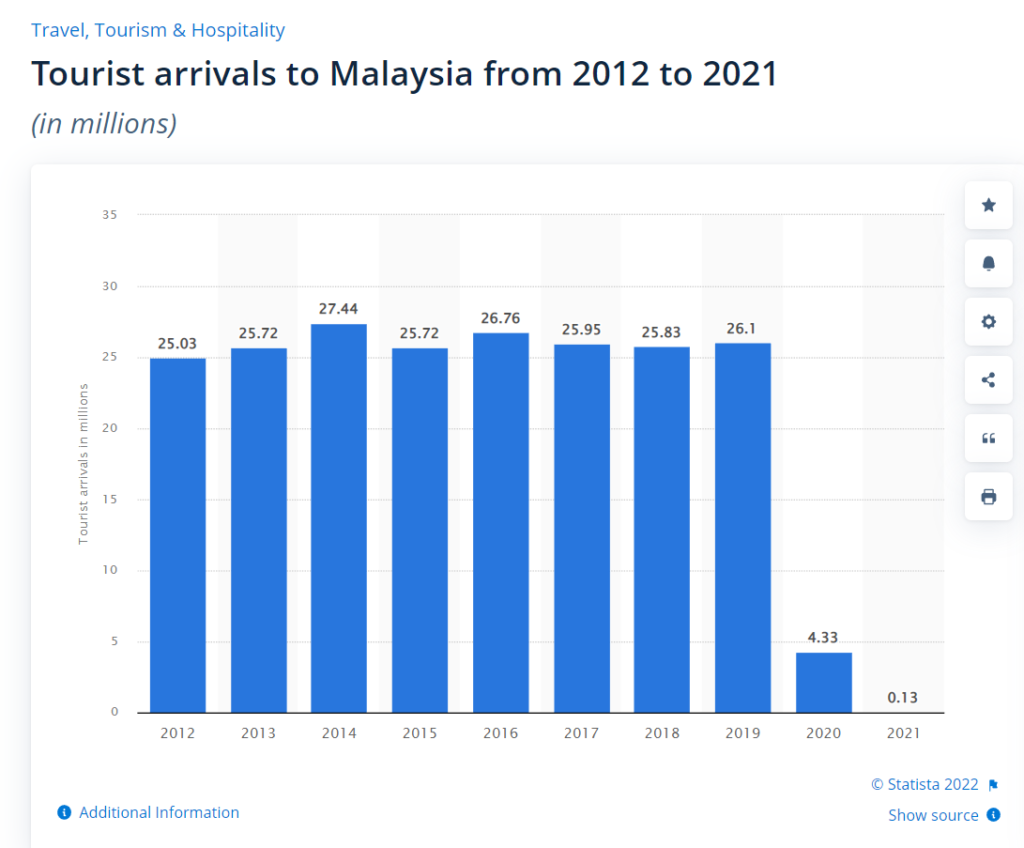

Before Covid-19 arrived, Malaysia used to be visited by 26 million visitors per year. (Source: https://www.tourism.gov.my/files/uploads/annual_report_2019.pdf). Meanwhile in 2021, we received just 135,000. Yeah, that’s in thousand, not in millions anymore. Would tourists be visiting Malaysia again? You can say no, that’s your opinion. I would say by 2023, we will be back to 2019 levels and we will be breaking that number in 2024 easily unless of course the world goes into a recession and no one bothers to travel and prefers to stay home and watch Netflix…

Take action regardless of what you believe

We could choose to continue renting if we are earning way above the rental we are paying. Everything would still be fine. We could choose to pay a mortgage and suffer a bit while our salary slowly builds up and at the same time, the property price moves up simply because of inflation effect. Do we want to see how much property price could rise if it is going up by just 1% every year? Simple calculation as below:

RM500,000 property x 1% increase = RM5,000 per year and this is roughly RM417 per month; rising.

If we are an assistant manager earning roughly RM5,000 per month and we got a typical 5% increment every year, that’s RM5,000 x 5% = RM250 extra per month.

If we have a property and has a job, then we are getting roughly RM417 + RM250 = RM667 per year; rising.

Just in case everyone wants to see if 1% is a valid number? Here’s the property price trend for Malaysia. We can see that except for that 1997/98 period, every year has been generally positive. So, 1% on average is a very probable number.

Happy Deciding. We do not need property investment to be rich yeah. We just need property investment so that we do not become poor from giving our money to homeowners who become rich from our rental.

Property News Malaysia? Sign up for daily investment news updates (FREE since Nov 2013 and FOREVER). Alternatively, Follow me on Telegram here.

Please LIKE kopiandproperty.my FB page to get daily updates about the property market beyond kopiandproperty.my articles. Else, follow me on Twitter here.

Next suggested article: It’s not an investment if we know nothing about it

Leave a Reply