Personal Finance 101: How to calculate / estimate EPF money we have when we retire?

You will need to be an EPF contributor first

In order to benefit from this article, you need to be an EPF contributor first yeah. As for EPF, much has been said about the recent RM500 being deposited by the government to EPF contributors who have too little money in their account. Some said that EPF members should be allowed to do another round of withdrawal. Some say it is irresponsible to allow that because these savings are meant for retirement days. Well, the debate rages on but for all other contributors, did you know that you could estimate how much total EPF money we have when we retire?

Step 1 – Login to KWSP

URL is here: https://secure.kwsp.gov.my/member/member/login

Image as below.

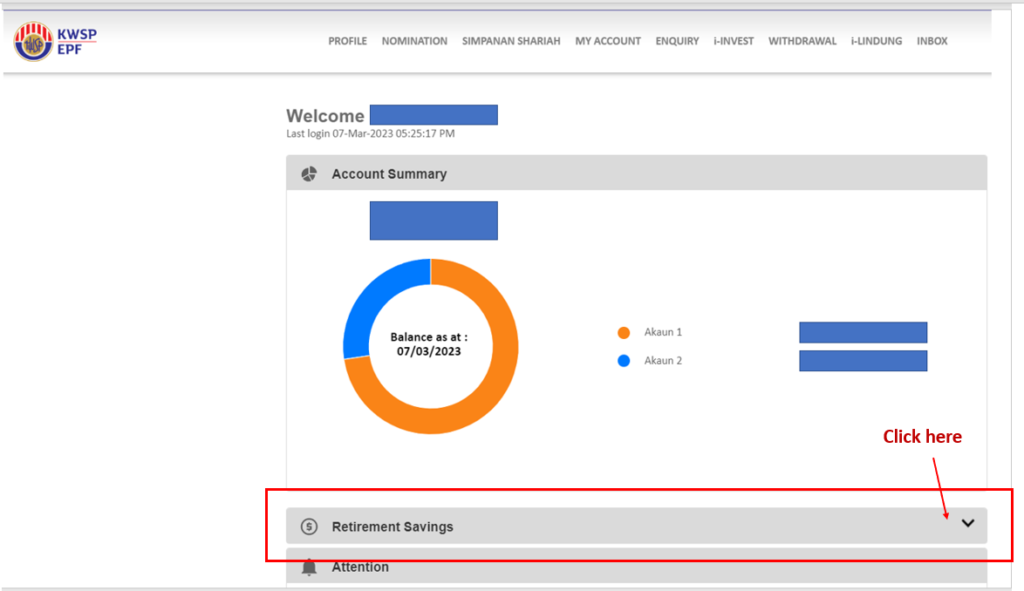

Once we key in our ID and password, we will come to an overview. Click where I show below.

Step 2 – Click on Retirement Savings

Once you click you will see this as per below: Click Retirement Savings

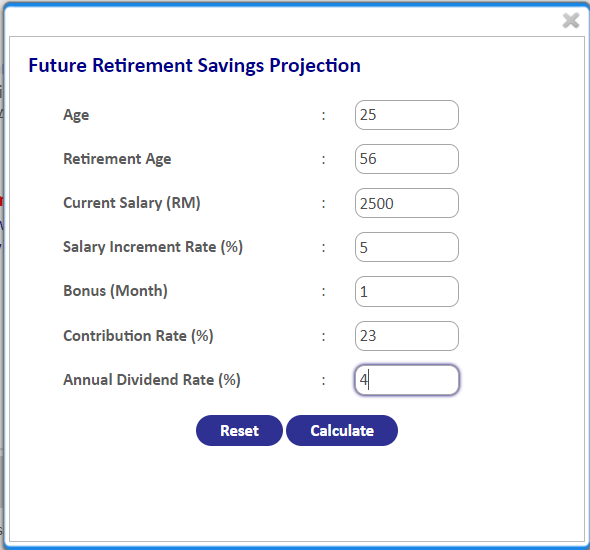

Future Retirement Savings Projection

Do fill up the necessary after you have clicked on “Calculate Retirement Savings” I have entered a sample as below. Please enter your own yeah. Then click “Calculate.

Upon clicking “Calculate” the amount you will have at the end of the retirement will show. By the way, as long as this person (example above) continue to move up the corporate ladder and EPF continues to give an annual divided rate of 4%, after working for the next 31 years, the person would have an EPF savings which is pretty comfortable and well above the minimum EPF savings of RM240,000 upon retirement. This is why we should get a good job, keep a good job and continue to perform in the job. 🙂

Happy trying and be happy and then continue to work harder too. I meant, smarter. Cheers.

Property News Malaysia? Sign up for daily investment news updates (FREE since Nov 2013 and FOREVER). Alternatively, Follow me on Telegram here.

Please LIKE kopiandproperty.my FB page to get daily updates about the property market beyond kopiandproperty.my articles. Else, follow me on Twitter here.

Next suggested article: It’s not an investment if we know nothing about it

Leave a Reply