Overhang properties up means property prices down?

Actually, how many is our overhang property units?

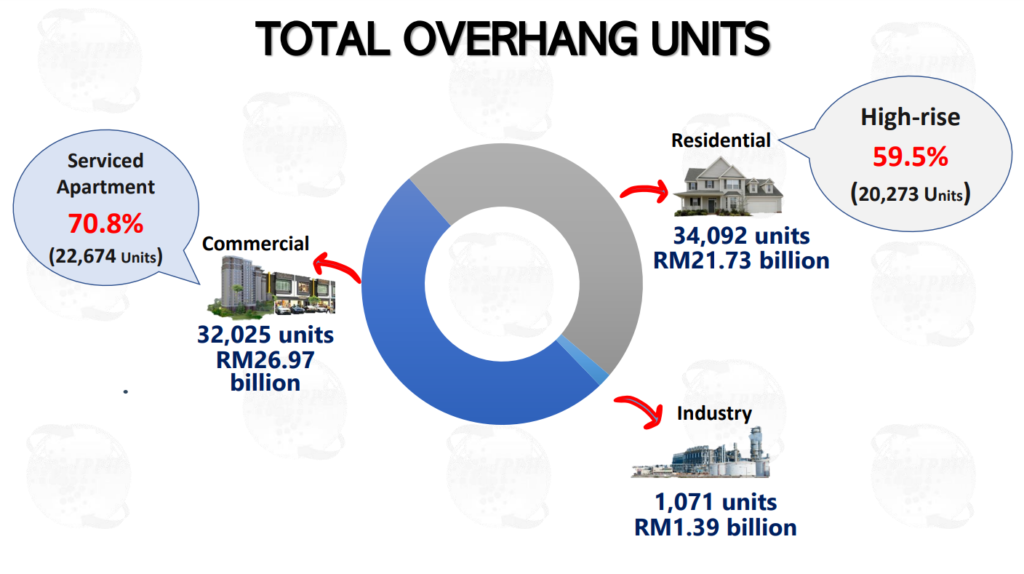

Let’s look at the Total Overhang Units to have an idea how many residential units are actually classified as overhang. Overhang property unit is defined as units that have received their Certificate of Completion and Compliance but remain unsold for more than nine months after launch.

Why do we have overhang properties?

There could be lots of reasons. First and foremost is that people did not want to buy it. They may not like the location, they may not like the price, they may not like the design, they may not like the developer and maybe they just do not think property investment is a clever thing to do. Perhaps they prefer to invest in something else or even just buy more materials goods and make themselves happy.

Regardless of the reason(s), what’s certain is that unsold properties are usually unwanted…

Why do property transactions happen?

Just within H1 2022, we have 118,000 residential property transactions. (by the way, the unsold properties are way smaller than this total transactions). Why does property transaction happen? Well, people may want to buy their first property, they may want to upgrade, they are thinking of staying closer to their in-laws, they bought a new car and needed a bigger house to park the car and more. In fact it may also be because they read kopiandproperty.my and realised property investment is compulsory!

Regardless of the reason(s), what’s certain is that property transactions happen because people wanted it and could afford to buy it.

Would prices go up if the property is under overhang?

Well, if the property developer could not sell the property at RM500,000 until it becomes classified as overhang then what is the chance that the developer can sell it by selling at a higher price? By the way, asking / selling prices can go up or come down but… without a transaction, then nothing happens to the property price yeah. It’s like we like to sell at RM500,000 and another wants to sell at RM400,000 and another wants to sell at RM600,000, the final price recorded officially into the national statistics would be the one that got transacted and not the ones which did not get transacted,

So, you can say that technically, property prices do not move up for unsold properties since there it was not transacted.

Why do property prices move up for property transactions?

I often ask this question when I am speaking in some public engagements.

“If you bought a property at RM500,000 what is the chance that you would sell the property for a lower price?”

Everyone in the hall would smile and answer a firm NO WAY.

I would respond the same if you ask me.

Now, let’s go to the potential buyer side then. When you love that particular property, would you be willing to pay a slightly higher price since the seller is not going to sell you lower than the price he / she bought? the answer is usually a Yes. Of course, some would argue that what if there’s a crisis? Surely the seller is willing to take a lower price? Well, in a crisis, the number of AVAILABLE and QUALIFIED buyers also reduced tremendously too…

In fact, even getting approval for the home loan may become harder as banks need to be even more diligent in their checking before lending to the potential buyer. So, total transactions would go down and in fact most sellers who could not hold would have sold but if majority of sellers are still selling at a price they like albeit lower, total prices would still show an increase.

Surely there are times when property prices would drop? (overhang is not the main reason)

Definitely. It has been shown throughout history that during the years of financial crisis, property prices do drop. We just need to remember what happened to the property prices after the financial crisis is over and then compare the prices 20 years ago versus 10 years ago and 10 years ago versus today. Then, read a little about inflation and 10 years later, you may want to compare to the prices today.

By the way, prices higher does NOT mean it’s higher value to owner

Surely everyone would have heard of RM50 10 years ago is more than RM50 today and RM50 10 years later will be lesser than RM50 today. This is the same as property price. RM500,000 today may just be equivalent to RM300,000 10 years ago, maybe. RM800,000 10 years later may just be RM500,000 today.

My question is a simple one. Could you save RM200,000 during that 10 years that property prices rose from RM300,000 to RM500,000? If you could, then do not buy property lah. Save the time, effort. Just save up the money. It’s the same question to those who say RM1,000,000 in the future is just like RM500,000 today. Could you save RM500,000 from now till that time when RM1,000,000 value drops to RM500,000? If you could, then forget property investment yeah.

Look at the property and look at the benefits. Not look at the overhang. It’s the wrong perspective.

All the best and take care.

Property News Malaysia? Sign up for daily investment news updates (FREE since Nov 2013 and FOREVER). Alternatively, Follow me on Telegram here.

Please LIKE kopiandproperty.my FB page to get daily updates about the property market beyond kopiandproperty.my articles. Else, follow me on Twitter here.

Next suggested article: JRK Convena, let’s look at the 6Cs and decide

Leave a Reply