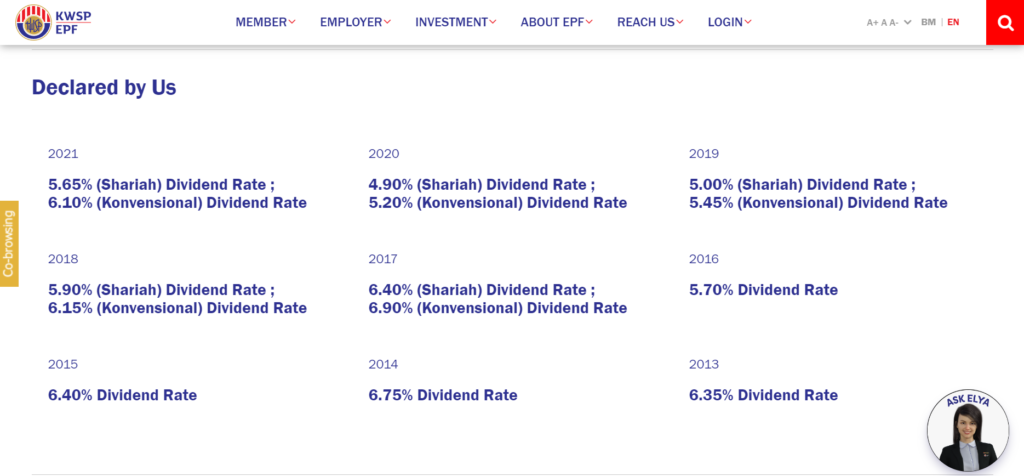

Our EPF returns over the years?

EPF has no money left

This statement has been mentioned to me many times by many different people. In actual fact, EPF has given me one of the best returns for many years and for recent years, the returns are higher than my FD returns and higher than the home loan repayment interest which I have to pay. There’s no guarantee it could be the same in the future but my wish is for this to continue and remain as high as possible.

This is where EPF is ranked among the other pension fund

Read the full article here by Mercer

- Mercer CFA Institute Global Pension Index compares 39 retirement income systems, covering almost two-thirds of the world’s population

- Malaysia ranked third among Asian retirement systems and 19th overall with an overall index value of 60.1

- The Netherlands and Denmark retain first and second place respectively and the coveted “A” grade

- The impact of COVID-19 on the provision of future pensions will be negative due to reduced contributions, lower investment returns and higher government debt

Malaysia’s grade meant that it’s on par with developed economies such as Hong Kong, France and United States.

Read the full article here by Mercer

19th overall in the world yeah and 3rd in Asia yeah. There are 48 countries in Asia just in case you want to know what 3rd in Asia meant.

An employee with a stable and growing salary, would have accumulated a substantial number in EPF when the person retires

Briefly, if one earns RM4,000 then the actual savings going into EPF is RM4,000 x 24% (both employer and employee) = RM960 per month yeah. In one year, this becomes RM11,520 and if we assume the returns from EPF is 5% on average, then 14 years later, the money we have in EPF is doubled. In many countries, employers do NOT need to contribute so much for the employee yeah.

Some other additional information about EPF

We can leave our money in EPF up to the age of 100 and the same “rate of dividends will be paid to all members based on the dividend rate declared for conventional or syariah savings”.

EPF had about 400,000 members with savings of RM500,000 and above in 2018. About 40,000 members have more than RM1 million each, while about three million members have between RM50,000 and RM100,000 in their account. Those with between RM100,000 and RM500,000 in savings make about 2.7 million contributors. (read here)

One can top up EPF contribution to a maximum of RM60,000 per year. Yes, based on EPF returns versus FD rates, I think this top up does make more financial return sense yeah. read here.

Happy learning. Do share with more people if you think they should also know.

Property News Malaysia? Sign up for daily investment news updates (FREE since Nov 2013 and FOREVER). Alternatively, Follow me on Telegram here.

Please LIKE kopiandproperty.my FB page to get daily updates about the property market beyond kopiandproperty.my articles. Else, follow me on Twitter here.

Next suggested article: Outlook for the property market 2022

Leave a Reply