When Non-Performing Loan (NPL) is high, we need to be worried

What is Non-Performing Loan (NPL)?

Investopedia says this about Non-Performing Loan. “A non-performing loan (NPL) is a loan in which the borrower is default and hasn’t made any scheduled payments of principal or interest for some time. In banking, commercial loans are considered nonperforming if the borrower is 90 days past due.”

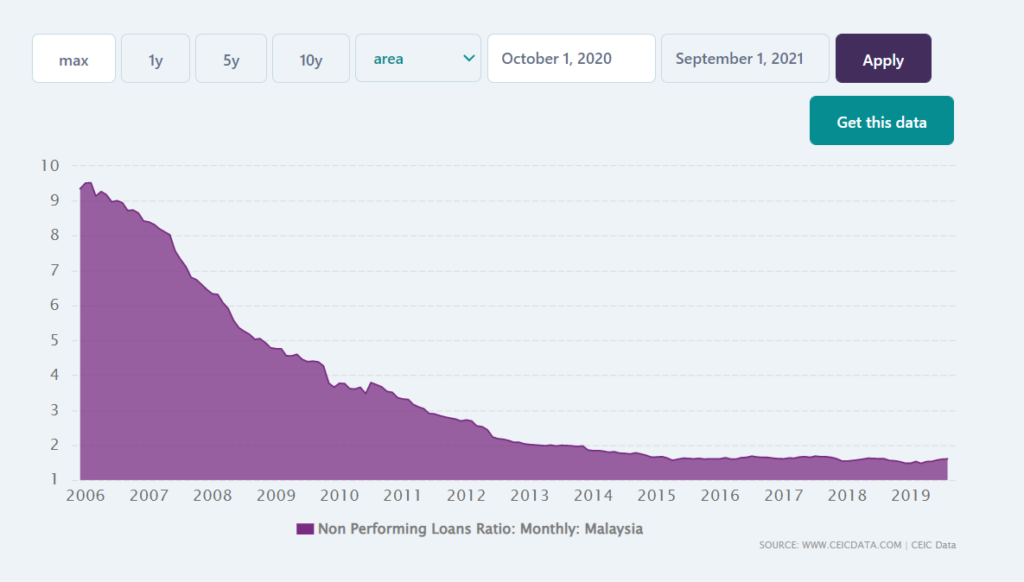

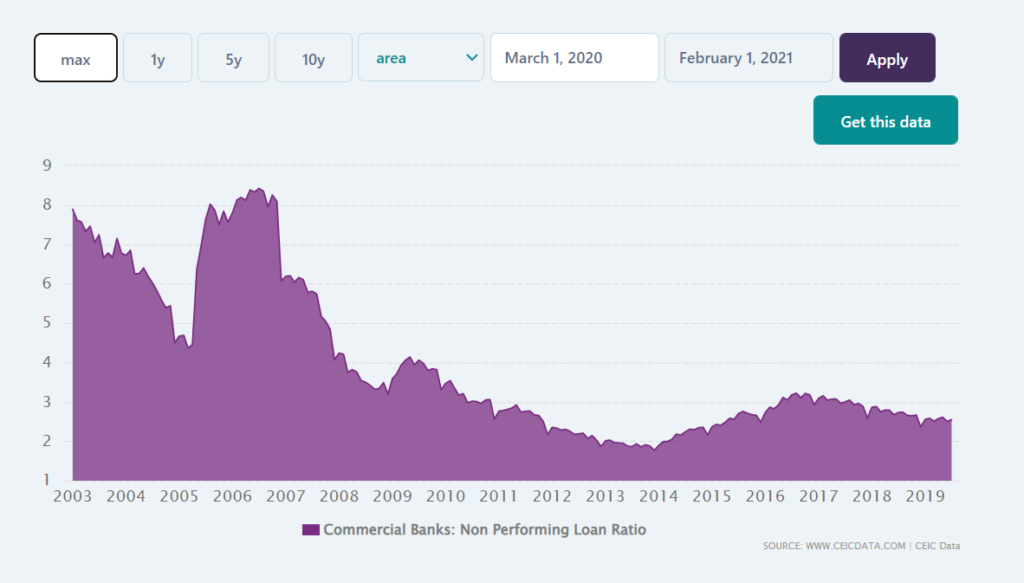

In Malaysia, Non Performing Loans (NPLs) are defined as loans overdue for more than 90 days. Below is a chart from ceicdata.com NPLs in Malaysia has been on a downtrend as Bank Negara Malaysia (BNM) wants the banks to be responsible with their lending.

Meanwhile the banks become conservative and only loan to the ones who really qualifies for the loan. Actually, in 1998 the NPL was higher than 10%. I think it was as high as 16%. We do have a positive situation here in Malaysia. The NPLs are now below 2%.

Now for the question, how high is considered high?

Generally, above 10% would be considered unhealthy. Banks may be reluctant to lend if their NPL number is more than 10%. However, I consider anything above 5% to start to be alarming. Let’s look at some of the more advanced economies and their numbers. Indonesia is included too because this will be the economy to focus on as one of the largest economies of the world by 2030.

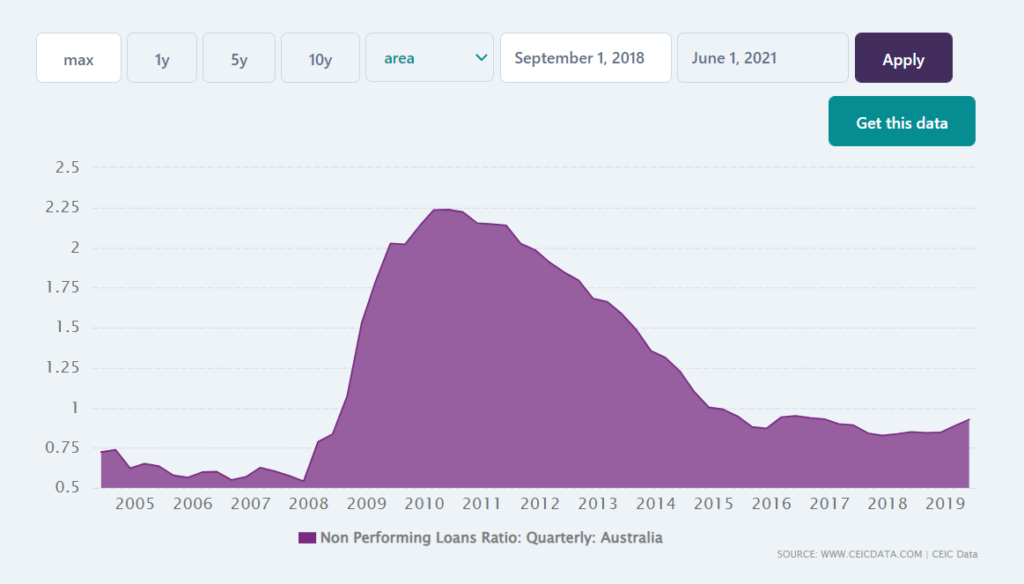

Australia has about 1.1% in NPL. (Chart Below)

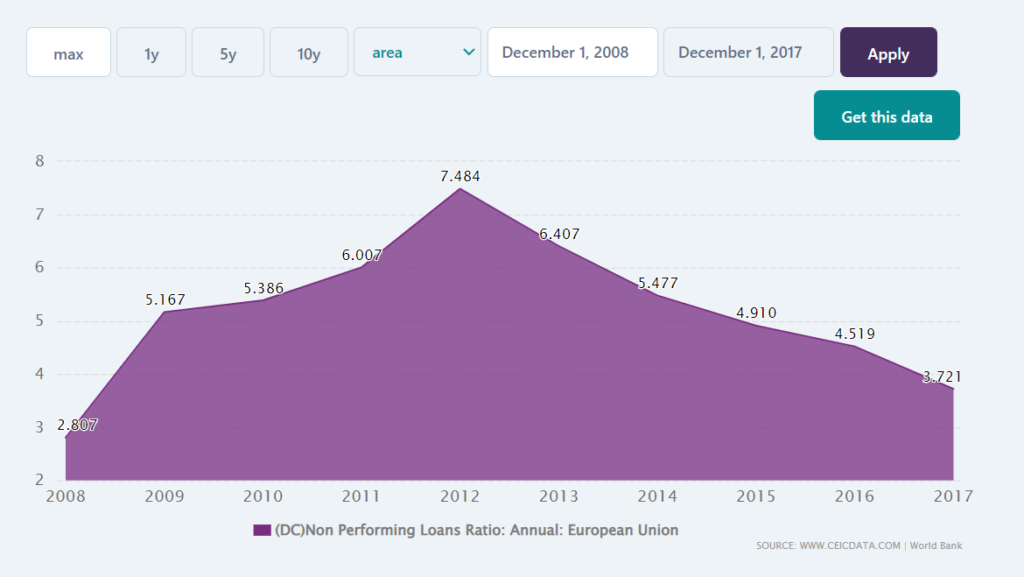

Meanwhile the European Union as a group has NPL number which is twice that of Malaysia. (Chart below)

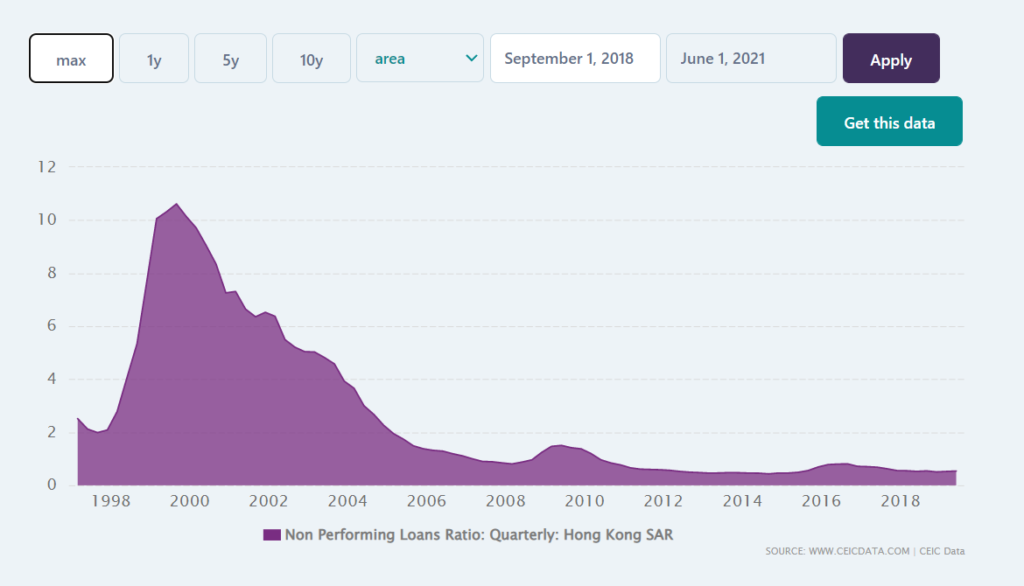

Hong Kong SAR’s NPL was highest in the year 2000 and this has been on a reducing trend since then and is oday below 1%. (chart below)

We can also see that Indonesia’s NPL is also on a downtrend when compared to 2006 / 2007. It’s currently around 3.2%. (Chart below)

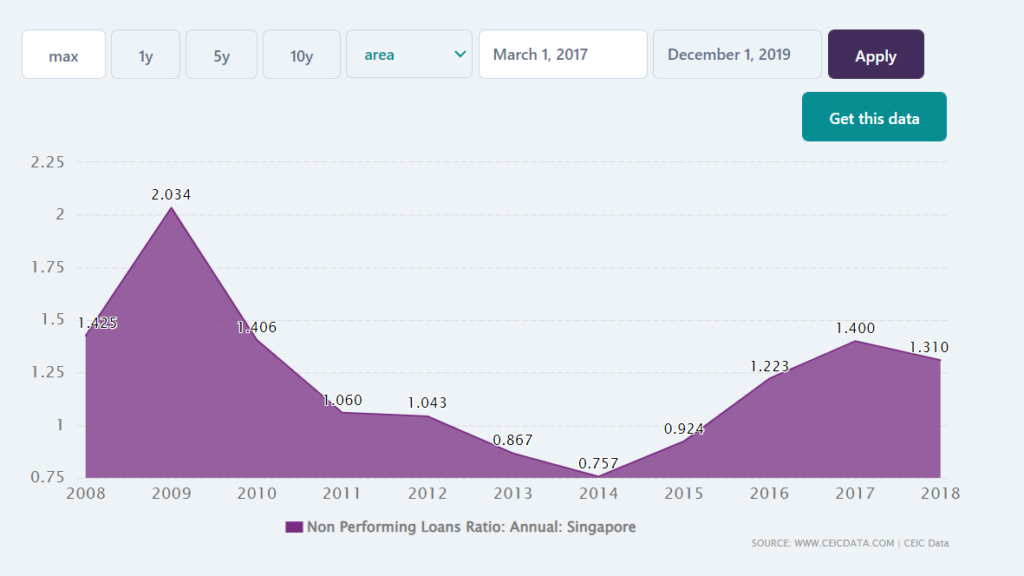

Singapore’s NPL meanwhile has always been rather low and is currently at around 1.3% which is slightly lower than Malaysia’s NPL

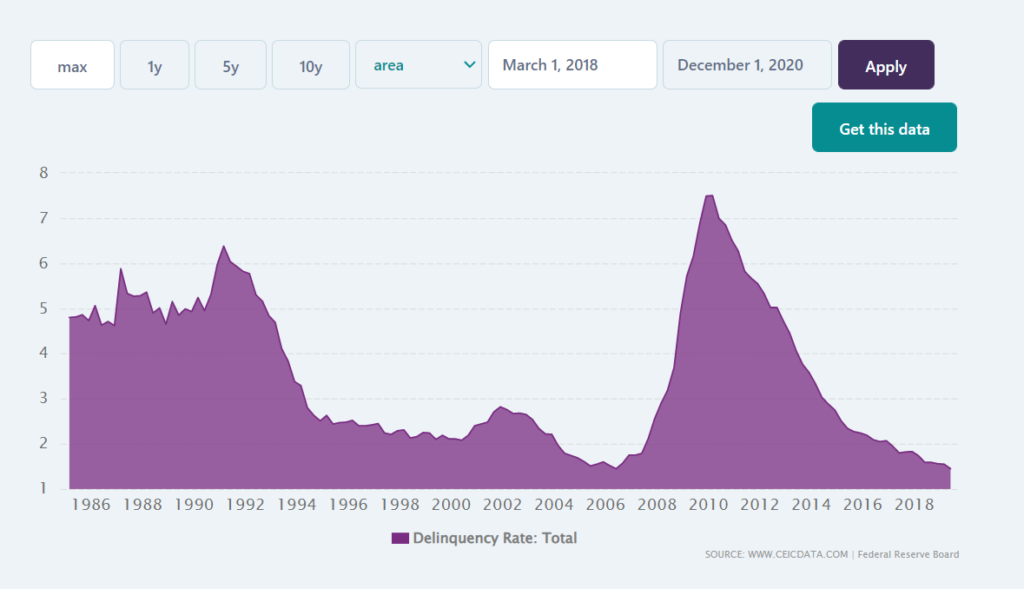

United States has the same NPL % as Malaysia too. They are at 1.6% and has been usually hovering higher than 2%. They were highest in 2010 and this was just after the 2008 Mortgage Crisis which was because of the real estate lending. (Chart below)

Conclusion

I do hope our BNM remains very vigilant to ensure our Non-Performing Loan numbers remain low. As for the question of whether the NPL is high, actually the answer is very subjective. Can see from many perspectives. Compared to some of these advanced economies, we are doing okay lah. Not that high actually. So, for now, it is safe to continue scouting for properties and continue to buy. The bank would not simply approve your loan application anyway. Cheers.

Property News Malaysia? Sign up for daily investment news updates (FREE since Nov 2013 and FOREVER). Alternatively, Follow me on Telegram here.

Please LIKE kopiandproperty.my FB page to get daily updates about the property market beyond kopiandproperty.my articles. Else, follow me on Twitter here.

Next suggested article: Buy before property price rises in 2022? Ahem…

Header Image by Alexandr Podvalny from Pixabay

Leave a Reply