Property transactions Malaysia: Numbers for H1 2022 looking good actually

Malaysia is not in a crisis, dear friend

First of all, thinking that Malaysia is in a crisis because US$ kept appreciating versus most of all currencies including Malaysia is not clever. Just in case anyone wants to know, British Pound reached a 35-year low versus the US$. AUD is at 2.5 year low versus the US$. Japanese Yen is at 24-year low versus the US$. Euro is at 20-year low versus the US$. I think the whole world will all be in a crisis except one country? 😛

Secondly, assuming this friend is right that Malaysia is going to be in a crisis, then he (yes… he) better be ready to potentially lose his job because during a crisis, banking jobs are not going to look that rosy. I also hope he has huge savings and is ready to invest into distressed properties using cash because if he loses his job, he is not going to be able to get a loan.

Remember, never say something and then do something else yeah. Many friends kept saying a crisis is coming and then continue to spend money versus saving it to be ready…

No crisis means property market will have support

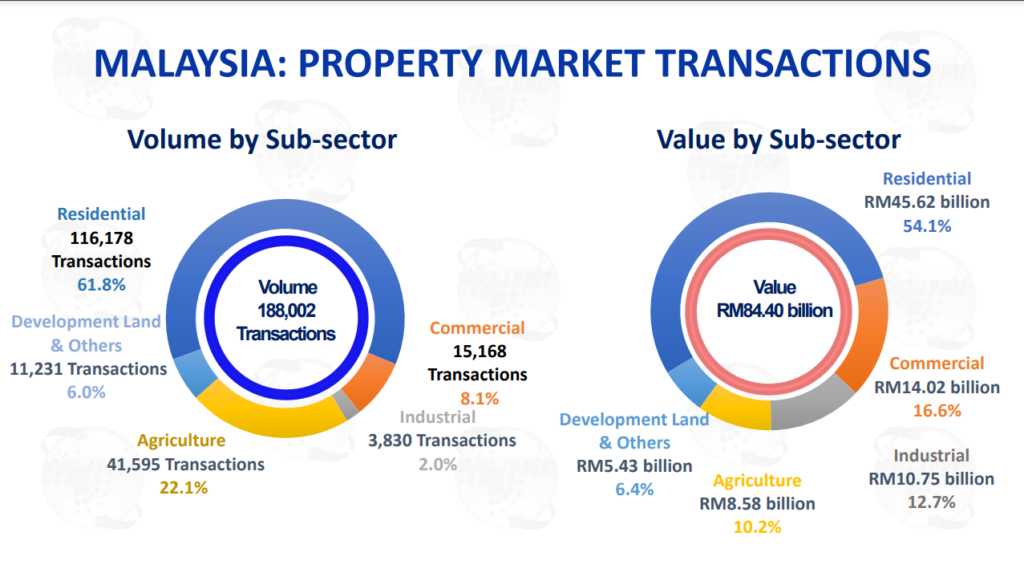

Take a look at the actual numbers below yeah. This is not from some comments among your social media friends (no matter which social media…). Total residential transactions alone is 116,178 and this is just H1 yeah. Usually, H2 numbers are higher for some years.

When property transactions happen, it means the borrowers could quality and the banks could lend because they qualify. Else, nothing happens. For example, during a financial crisis where borrowers are scared to commit and banks are scared to lend without a super stringent and thorough check.

We will see what happens then.

Trend for volume and value for transactions are also trending upwards. Good news for owners who managed to sell at a higher price than the price they paid for probably a few years ago. Take the profit and perhaps invest into another good property.

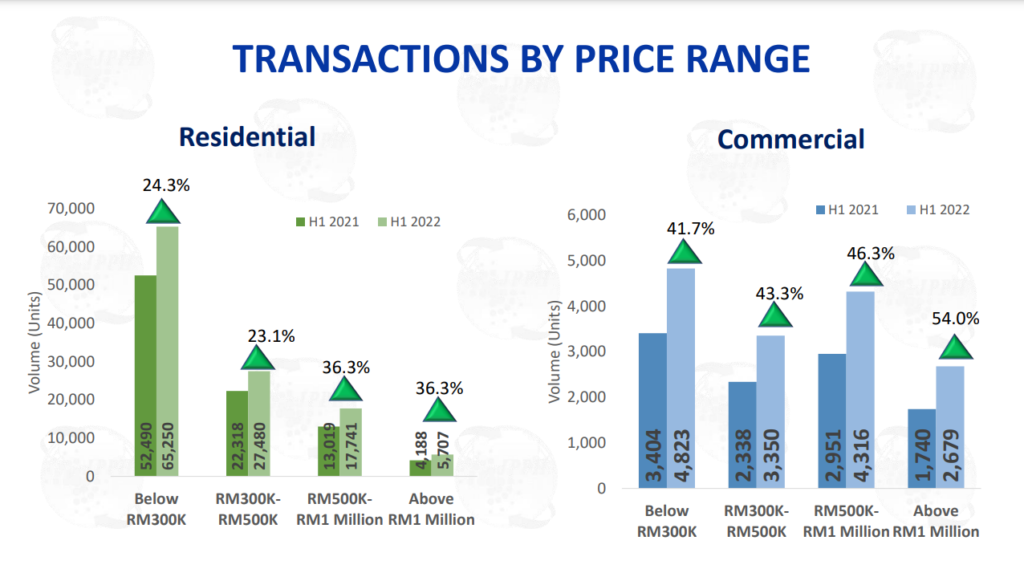

No prizes for guessing right. The cheaper properties would usually have more transactions but please do look at the general trend which is showing a rising trend. This is across all residential and commercial properties too. Briefly, the economy is definitely supportive and the banks are willing to lend too. This meant the banks could trust the borrowers yeah. They usually do stringent checks.

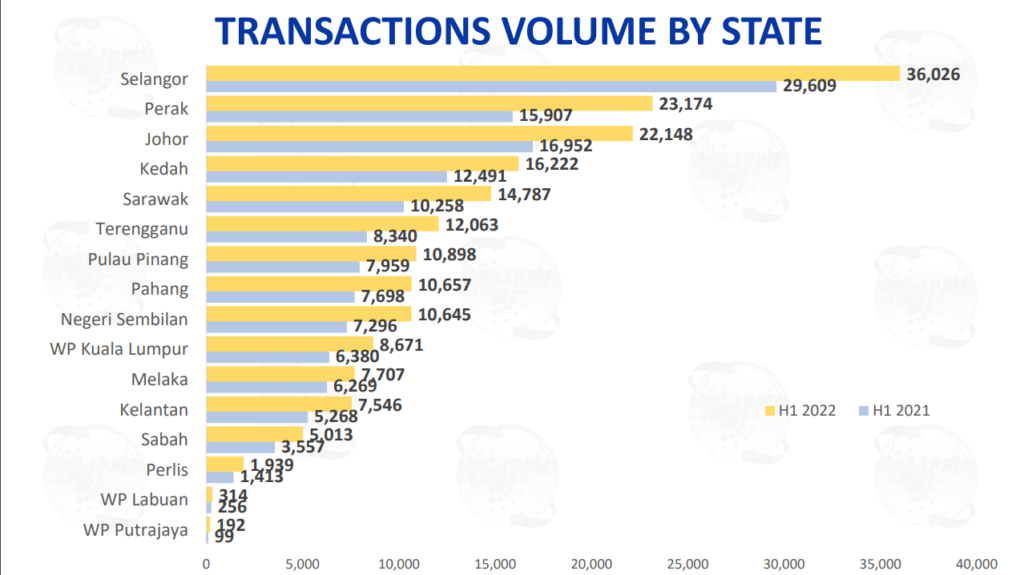

Selangor property transactions are the top and this has been the case as usual. Klang Valley remains that place where most of our graduates would flock to for employment opportunities. Businesses may also be setting up there to cater to an ever increasing demand because of migration from smaller towns to bigger cities too.

Conclusion: H1 2022 has been a good one

If you still believe a crisis will be happening soon, just be very prepared to take the opportunity if it arrives. Do not just say and do nothing and then when opportunity came knocking, we do not have the funds to buy low and sell high a few years later. Happy believing and deciding.

Here’s the link for NAPIC. They have a lot of very good stats and numbers there. Always visit them often, else subscribe and I will share too every time they post anything together with my views too.

Property News Malaysia? Sign up for daily investment news updates (FREE since Nov 2013 and FOREVER). Alternatively, Follow me on Telegram here.

Please LIKE kopiandproperty.my FB page to get daily updates about the property market beyond kopiandproperty.my articles. Else, follow me on Twitter here.

Next suggested article: It’s not an investment if we know nothing about it

Leave a Reply