IOI Properties Group Bhd is a value-buy

By the way, property investment does not need to be buying the actual property which may require 10 percent downpayment. A RM350,000 home would require a minimum of RM35,000 just for the down-payment. Wow… No wonder so many people are complaining that they could never save enough money. (at the same time, many are spending away all their salaries online…). Here’s that danger when the emergency savings is even lower than credit card debts! When 47% have less money in emergency savings than credit card debt (click to read)

However, there’s also another option. Buying the stock of the property developer instead. Here’s one potential one according to RHB Research. Read on about what their analysis is showing.

Article in nst.com.my RHB Research says that IOI Properties Group Bhd is showing value. This is because of the increasing stream of recurring income, especially upon the completion of Central Boulevard next year. RHB Research said the construction of the Grade A Green Mark Platinum office towers would be completed in 2023.

It said, “We are optimistic on the rental prospects of this asset as quality office space is highly sought after with the expansion of regional technology/telecommunication sectors in recent years.

“Management also indicated that the initial response for leasing looks quite promising. Assuming a conservative rental rate of SG$10-SG$11 per sq ft, Central Boulevard can generate a whopping RM350-RM450 million in rental income per year.” with this, it will form good earnings base for the company to raise its dividend payout in the future. RHB has maintained its “Buy” call on IOI Properties, with an unchanged target price of RM1.38. Do read the full article here: Article in nst.com.my

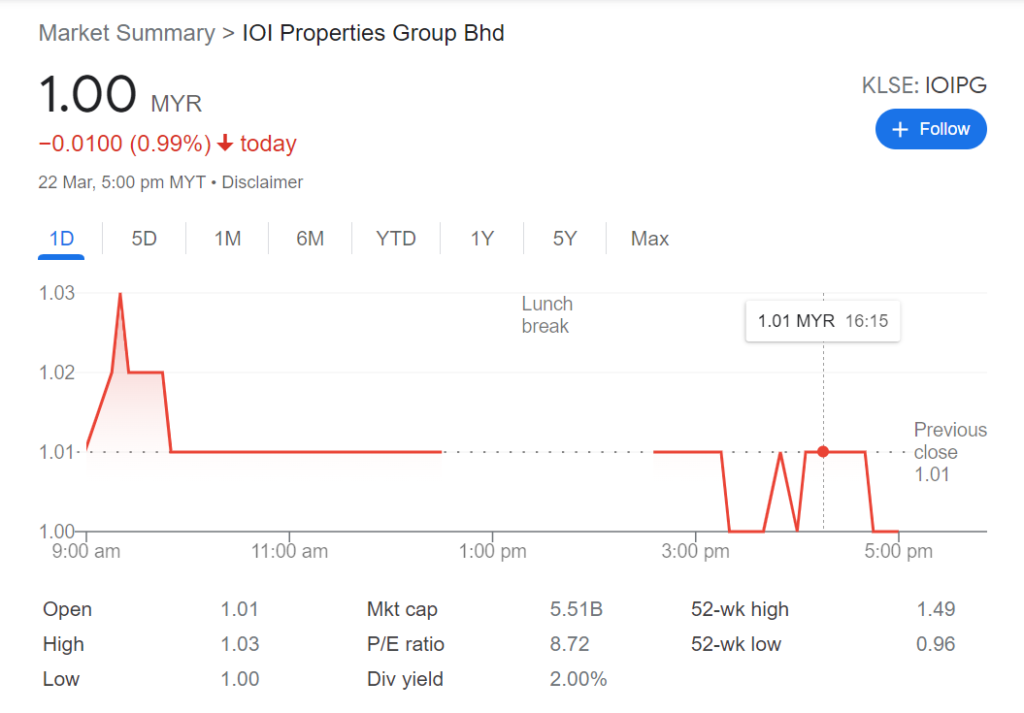

What’s the price as at 22 March 2022?

The price today meant that there’s an upside potential of 38% from what RHB is targeting. I do not own any IOI Properties shares currently. Buying or not buying is your own decision yeah. Just note that dividend yield which is at 2% based on current price will only be increasing if the contributions from the Central Boulevard is coming and is really as per expected.

Property News Malaysia? Sign up for daily investment news updates (FREE since Nov 2013 and FOREVER). Alternatively, Follow me on Telegram here.

Please LIKE kopiandproperty.my FB page to get daily updates about the property market beyond kopiandproperty.my articles. Else, follow me on Twitter here.

Next suggested article: Property is no longer a key retirement asset

Leave a Reply