Interest rate will go up further in Jan 2023

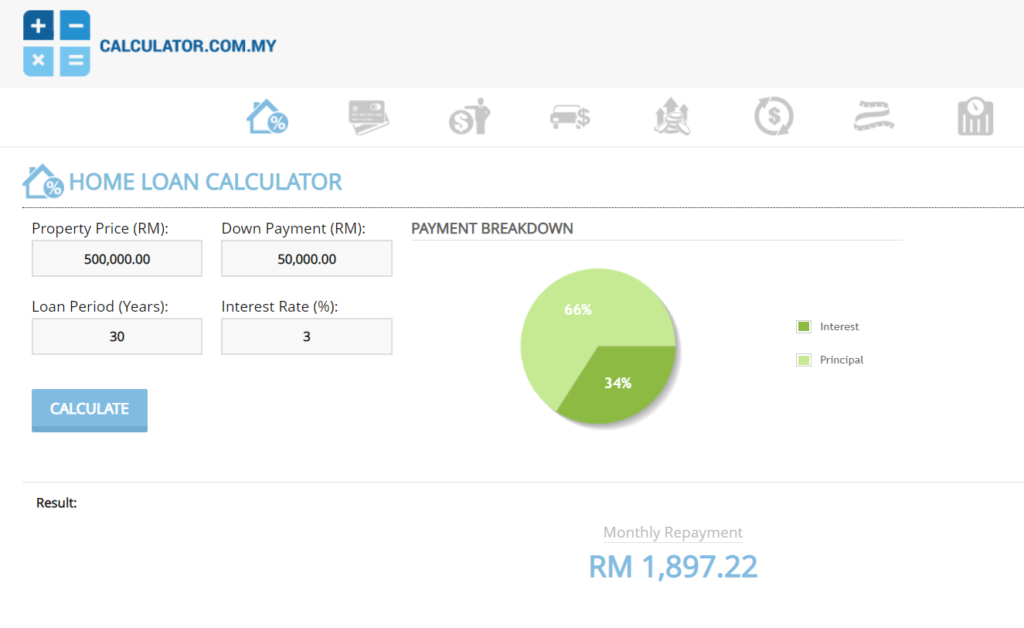

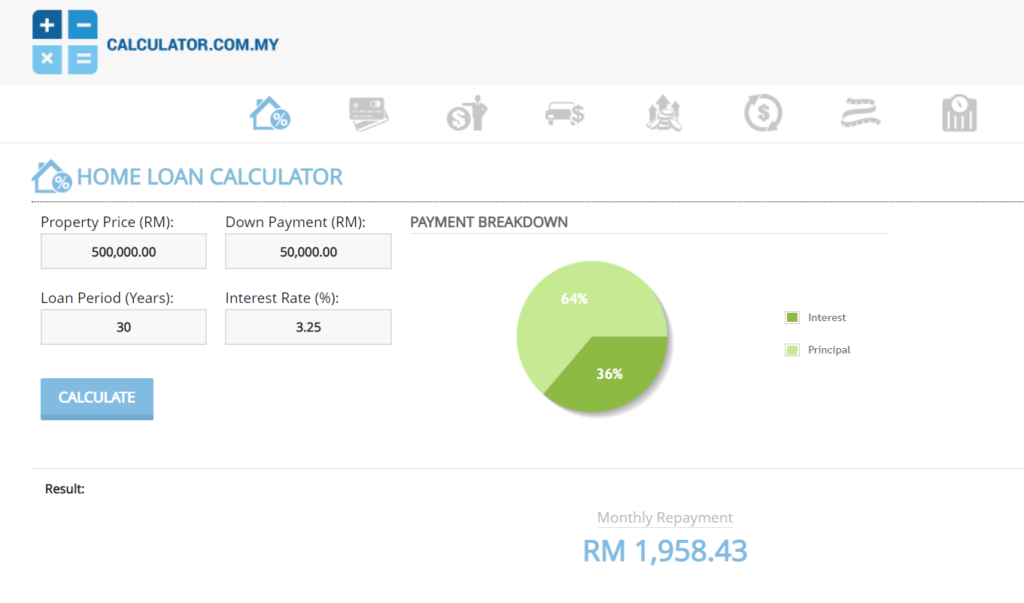

Maybank IB says that it’s possible for Bank Negara Malaysia (BNM) to increase the rate by another 25 basis points. It’s 0.25%. If we are thinking of buying a home or even paying for a mortgage currently, what’s the impact of this potential 0.25% rate increase? For a RM500,000 home and a 10% deposit, a change in 0.25% rate would mean a change of monthly repayment by roughly RM61.

Take a look at the two screenshots from a very informational site. We see the difference between a 3% home loan rate versus a 3.25% home loan rate. You may visit them too. www.calculator.com.my

If you like to refer to the full article quoting what Maybank Investment Bank Bhd said, it’s here: Article in nst.com.my

Maybank Investment Bank Bhd (Maybank IB) expects another 25 basis points (bps) hike in the overnight policy rate (OPR) to 3.00 per cent at the first Bank Negara Malaysia (BNM) monetary policy committee (MPC) meeting on Jan 18-19, 2023. It said, “The monetary policy statement (MPS) reiterated that the monetary policy stance is still accommodative, not on any pre-set course, data-dependent and monetary policy adjustment will remain measured and gradual.”

“To note, BNM has tolerated periods of negative real OPR and negative differentials between OPR and the US Federal Reserve’s (Fed) funds rate in the past.”

The research house said in the current context of BNM’s current OPR hike cycle – the fourth successive 25 bps hike in the OPR at the final MPC meeting of this year – and a little over two weeks before the polling date of the 15th General Election (GE15) – underscored BNM’s independence in its monetary policy decisions. Article in nst.com.my

Is extra RM61 per month considered a high amount?

Actually, if we really look at it from the number perspective, it’s just RM2 per day. In fact, RM61 can be saved by one less dinner at some fancy restaurant easily. However… the 0.25% was not the first and is not expected to be the last. In fact, BNM has hiked 1% thus far and 1% is actually equivalent to around RM230 per month. Depending on how tight someone was with the home repayment, an extra RM230 may be very heavy indeed. Plus the fact that there may be another increase in January 2023…

Decision will depend mostly on sentiment though

If people do not feel secure, they will be more inclined to save the money instead of spending it. Property purchase wise, it’s such a big decision that if there are uncertainties, the tendency is to delay the purchase and only buy when the whole world seems to be buying. Of course that may not be the best time but majority would only feel secure if the majority are doing it. So, frankly, whether it’s RM61 or RM230, the transactions will increase if the sentiment is positive. One of the cause would be the election results. Happy voting and all the best.

Property News Malaysia? Sign up for daily investment news updates (FREE since Nov 2013 and FOREVER). Alternatively, Follow me on Telegram here.

Please LIKE kopiandproperty.my FB page to get daily updates about the property market beyond kopiandproperty.my articles. Else, follow me on Twitter here.

Next suggested article: It’s not an investment if we know nothing about it

Leave a Reply