EPF savings is not going to be enough. Be savvy and be ready please.

Did you know that “Close to 50% of EPF contributors have less than RM10,000 in their account.” Read the article here: 50% of EPF constributors have less than RM10,000 in their account So, the situation is real and the fear should start sooner rather than later if someone is within this group of EPF contributors who has less than RM10,000 currently. Even assuming the money doubles by the time they retire, it’s still only RM20,000.

EPF’s savings are supposed to last the members for 20 years. RM20,000 for 20 years is only RM1,000 per year or RM83 per month. Daily basis, that’s RM2.75. Yes, the number if real if we do not do something about it earlier, versus later when it’s too late.

What is EPF Basic Savings quantum?

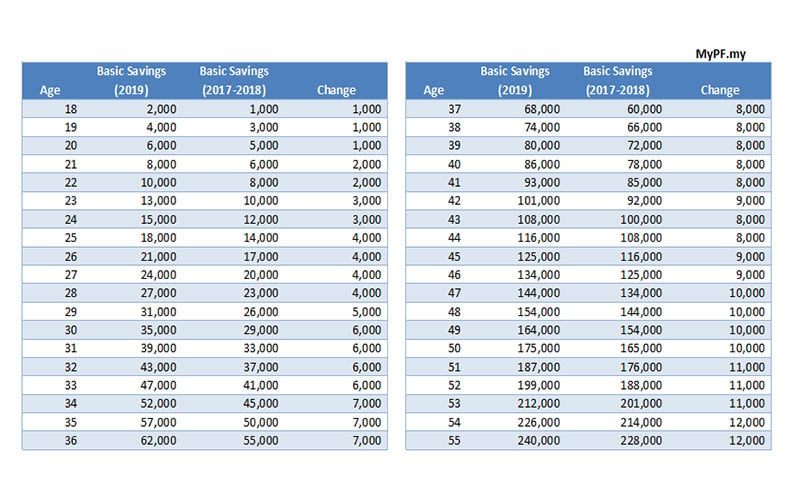

The EPF Basic Savings quantum is revised periodically according to the minimum pension for public sector employees, or every three years, whichever earlier. The last revision took effect in 2017.

The latest EPF basic savings will take effect on Jan 1, 2019. The quantum for the Basic Savings will be revised from the current RM228,000 to RM240,000, the minimum target EPF basic savings members should have upon reaching age 55. Please refer to the image below showing how the EPF sees how one grows their EPF Basic Savings over the years until they stop working at 55. I know, most people would work to 60 these days.

Why is the amount for EPF basic savings revised upwards?

Well, basic Savings refers to the amount considered sufficient to support members’ basic needs for 20 years upon retirement. Means we retire at 55 and the amount of money in the EPF is enough to sustain us for 20 years. In other words, RM240,000 at the end will be enough to cover the cost of living when one’s income has stopped or reduced tremendously.

RM240,000 divided by 20 years = RM12,000 per year or RM1,000 per month or RM33 per day. That’s around RM11 per meal. If one eats simple meals, it should be enough even if we have to consider inflation as well. However, the reason it is revised upwards is also because the cost of living is also getting higher too. Remember also that Malaysians are living longer too.

It’s not just EPF savings yeah. One needs more.

Article in nst.com.my In Scandinavian countries, where standards of care for the elderly rank among the finest in the world, the approach is holistic and includes housing, healthcare and where necessary, companions and also financial allowance.

In short, senior citizens who are without family support get social welfare care from the government. Japan, for instance, earns much praise for its protection of people’s dignity. Thus, EPF cannot be the only guarantor for the wellbeing of the elderly. Needs of the senior citizens encompass more than mere money. Do read the full article here: Article in nst.com.my

Before we think we are alone with EPF savings…

By the way, worrying after retiring is a real issue and it is in all countries and not just Malaysia. Yes, I know you think the government can do way better. I agree totally. Just need to remember that the government is not going to be able to care for everyone no matter how awesome they may be. We can look at some happenings in other countries too.

1 in 6 of all Britons who are retiring soon does not have private pensions savings… yet. Read here.

25% of all adult Americans have no retirement savings… Read here.

2 in 3 of working Singaporeans do not have savings to last them more than 6 months. Read here.

Okay, I know the EPF savings problem is real, what do I do about it?

It’s a super long answer but at least these few Personal Finance things. It is in this order: salary – savings – invest. Which stage are you at today? A good friend who’s earning very good money and staying in a RM1.6 million semi-detached home in a gated and guarded place told me that she does not think she can retire. The reason? Her personal cost of living is just too high… Please learn from this as well. Many times, it’s also our personal cost of living yeah.

No paying rental please, it will be disastrous

Beyond these, remember one important point too. No one should sleep on the streets or under the bridge. That’s why it’s important to own at least one small place and stop worrying about rental when our income is no longer growing. Please never try to think of paying rental after 55 okay. Even RM500 per month for a tiny little room will ‘kill’ the savings super fast. Just look at the above calculations yeah.

Nope, there are no home owners who will allow the tenant (no matter how friendly the tenant is) to stay forever just because the tenant has paid 30 years of rental. It does not work that way okay… Please do feel free to google about why property and poverty is usually on the same page, especially when salary increase will always be behind property price increase. Hope everyone understands yeah. Blaming the EPF (low EPF savings), the government (should have been whoever your favourite government may be) or anyone for that matter does not help the matter much. Take care.

Property News Malaysia? Sign up for daily investment news updates (FREE since Nov 2013 and FOREVER). Alternatively, Follow me on Telegram here.

Please LIKE kopiandproperty.my FB page to get daily updates about the property market beyond kopiandproperty.my articles. Else, follow me on Twitter here.

Next suggested article: Renting is better than buying? Whoa…

Leave a Reply