Knight Frank: The Outlook for Malaysian Hotels 2023

As a well-known gastronomic hotspot in South East Asia, it was great to read that Malaysia has been finally validated on an international scale with the Michelin Guide covering two wonderful culinary hubs, Kuala Lumpur and Penang – 32 restaurants obtained the Bib Gourmand and 4 restaurants obtained a Michelin star. Malaysian cuisine is one of many traditional attractions for tourists together with its lively cultural scene, museums, majestic tropical rain forests, and some of the best islands and beaches in the region.

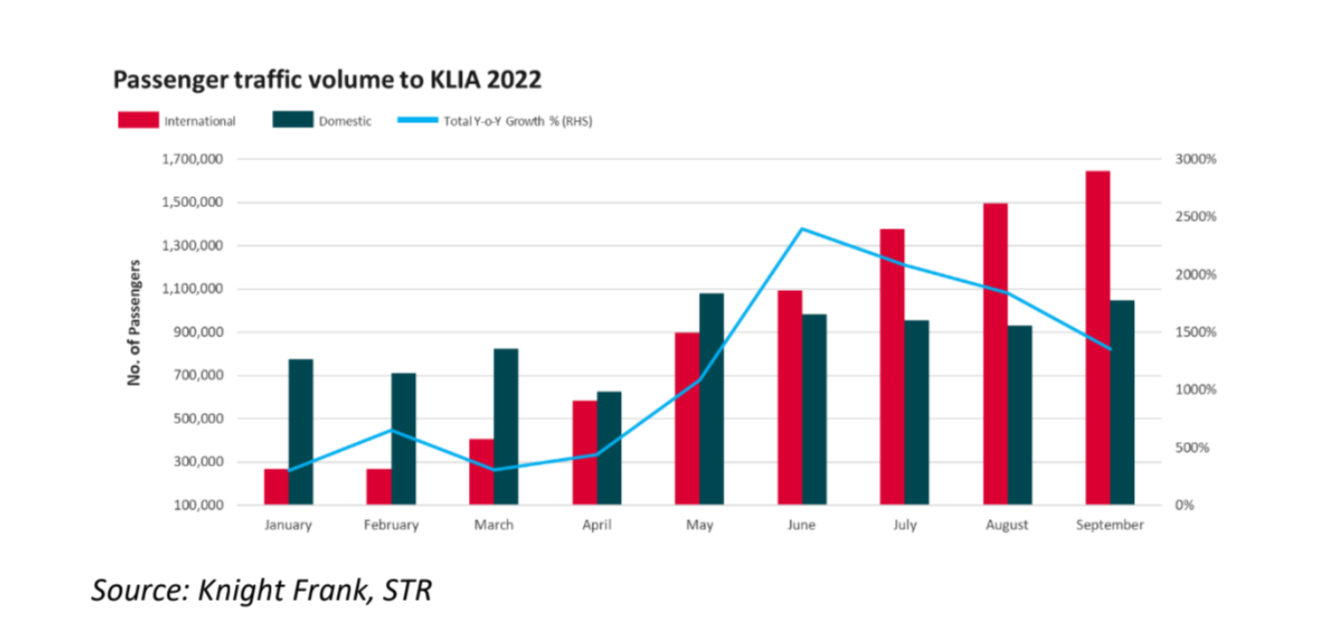

The country received 26.1 million international visitors in 2019 bringing in a total of RM86 billion in receipts. In 2019, Malaysia’s three (3) biggest markets were Singapore (10.2 million), Indonesia (3.6 million), and China (3.1 million), and strong growth in tourists was witnessed from India (22.5%), Indonesia (10.5%), South Korea (9.1%), and Japan (7.6%). Since the beginning of 2022, international passenger traffic volume to KLIA has been rebounding with average month-on-month growth of 27%, boosted by the complete removal of border restrictions, improving flight connectivity, and easing of regional travel restrictions. In September 2022, KLIA received 1.64 million international travelers, or about 53% of September 2019 of 3.51 million. Of course, when China does eventually lift its travel restrictions, this will provide an added boost. Halal tourism provides huge growth potential for the Malaysian hotel market with international Muslim travelers growing by 7.5% CAGR between 2013 – 2019.

Malaysia is the top-ranked destination in the Mastercard-Crescent Rating Global Muslim Travel Index 2022 and Kuala Lumpur, Penang, and Langkawi are particularly well-positioned to capture this market.

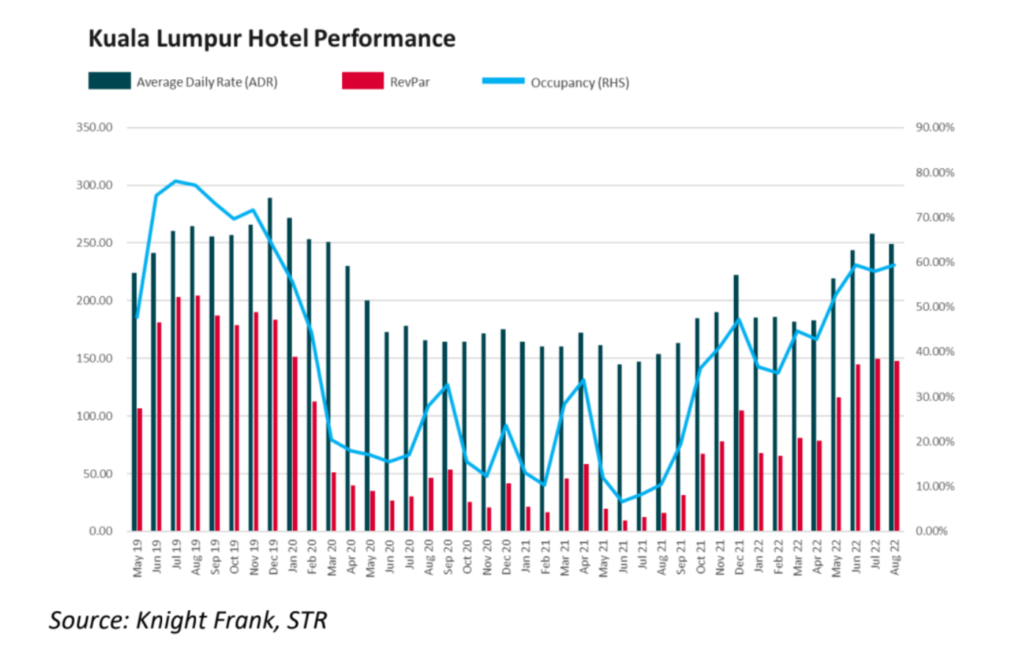

Hotel occupancy in Kuala Lumpur has been rising since the start of 2022, reaching 60% in August 2022. The city has been successful in pushing up the Average Daily Rate (ADR) which was only 6% down from August 2019, although less successful at improving its Revenue Per Available Room (RevPar) which was down 28%.

Table: New Hotels Scheduled to Open in Kuala Lumpur

We expect the recovery in the Malaysian hotel market to continue in 2023. The demand outlook is strong. On the supply side, Kuala Lumpur’s existing hotel stock of 47,500 is forecast to grow by 9% over the next 3 years and about 60% of this new supply will be in the luxury and upper upscale segments which are currently underrepresented. We feel these new luxury offerings will make Kuala Lumpur a more attractive holiday destination, boosting occupancy and growth in hotel revenues.

We are forecasting that Kuala Lumpur hotel occupancy will reach about 75% by late 2023, with RevPar recovering in 2024.

— end of media release —

Property News Malaysia? Sign up for daily investment news updates (FREE since Nov 2013 and FOREVER). Alternatively, Follow me on Telegram here.

Please LIKE kopiandproperty.my FB page to get daily updates about the property market beyond kopiandproperty.my articles. Else, follow me on Twitter here.

Next suggested article: It’s not an investment if we know nothing about it

Leave a Reply