Property investment: Price Appreciation, Yield, Risk and Diversification.

I am sure stock market returns are amazing. Some say they can easily earn double digit returns. As I have friends who could actually do so, I do believe this claim. However, these are minority and definitely not the majority. Else, everyone would now be in the stock market and not in the job market.

However, to some of these over eager people, there’s really no need to stereotype property investments as low returns yeah. Or even that it’s no longer a great asset for retirement. Please read here for the full article about property as a retirement asset.

Today, we just look at 4 parameters when it comes to investments yeah. They are price appreciation, yield (rental maybe?), riskiness, and diversification.

#1 Price Appreciation

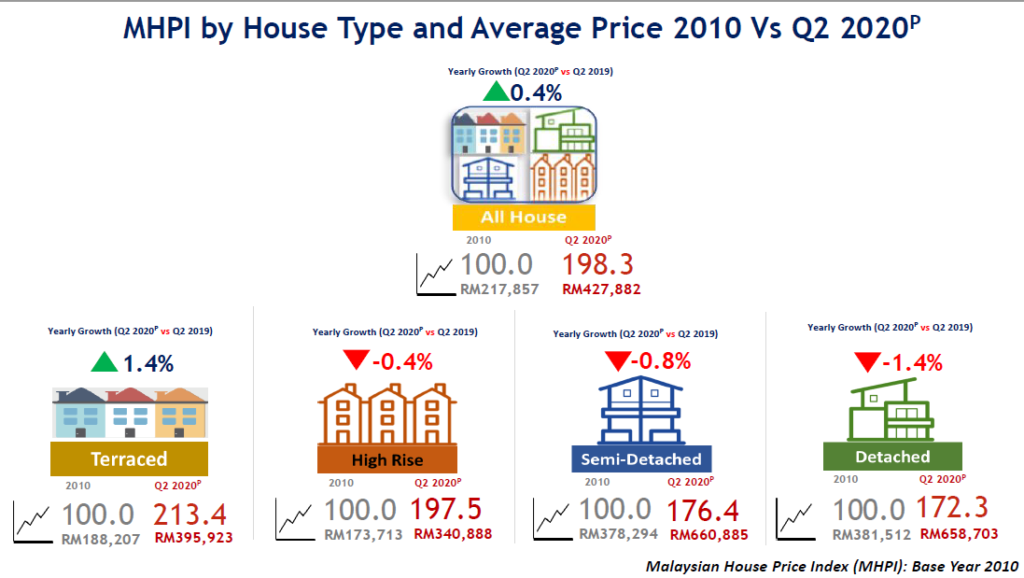

Let’s not talk a lot lah. Let’s just show the actual number. 10 years historical numbers from NAPIC as below. The worst performing would be detached homes, usually also known as bungalow. It only went up by 72.3% after 10 years. if we use a simple calculation, that’s roughly 7% per year.

I am sure there are many stock(s) which price has appreciated more than 72% after 10 years… Just do not assume majority of all the listed companies could achieve this same number yeah. I meant, AVERAGE wise…

#2 Yield

I believe everyone would think the yield refers to the dividend from stocks we hold or the rental yield from a property. Are all stocks providing positive dividend yields? The answer is a firm, no. Some provide better yields than the fixed deposit but it’s not even common that all stocks would provide dividends every year!

Are rental yields positive? This is best answered by people who bought properties and rented them out yeah. If they bought an undervalued property, the rental yield is definitely positive. However, more often than not, many investors paid much higher for a property than what the rental could yield. Is this about the property… or about the buyer…?

Rental will increase slowly over many years. This is why property owners who have owned the same property for over 10 years, their rental yield is definitely positive. Example? RM312,000 condo (current price is RM550k) with monthly rental of RM1,600. Another RM338,000 (current price is RM400,000) condo has a rental of RM1,500 per month.

One more is RM188,000 walk-up apartment (current price is RM250,000) and being rented out for RM1,000. By the way, all these are REAL numbers. However, it did not happen suddenly…. So price appreciation happened and yield has also been positive.

#3 Riskiness

We can accept the risks from buying into a company we may have never stepped into… Or a company which we do not even understand what they were manufacturing… or a company which we did not even know where their production plant is…

By the way, even for people who bought into banking stocks, do they know how the banks actual derive their profits? Is it from home loan? Personal loan? Or is it from their investments? If we did not know anything at all, it means we assume it’s low risk because it’s a familiar name? Erm…

However, we think property investment is risky? We can compare similar properties… We can view the actual property… We know what’s the typical rental… And we think this is more risky than the stock market? Of course… if we did NOT do any due diligence, when we bought an overpriced property… when we bought a property without even driving to the site and relying only on 360 virtual video… when we believe whatever the real estate agent told us about the rental potential… Come on, if we did no due diligence, is it the property or us…?

#4 Diversification

Diversify our investments yeah. For kopiandproperty.my followers, you would know that I do not just invest into properties yeah. Just do enough due diligence regardless of what we invest in to be safer. Remember, no matter what happens, we will still need a place to stay. That’s why that FIRST PROPERTY must be purchased earlier and not later because property will always be a hedge against inflation.

The price of RM85,000 may seem small for my Ipoh home today but 30 years ago, this RM85,000 is a LOT of money for my parents. By the way, RM500,000 will seem small 30 years later yeah. All these are caused by inflation. Just one property at least. Diversify if you must for everything else

Conclusion

I love the stock market too but there is really no need to keep putting the property market down… (so that you get more people to invest into the stock market?) Hope the above explains with real numbers what happens with property investment when it comes to the 4 things often mentioned by many other investments; price appreciation, yield (rental maybe?), riskiness, and diversification. Thank you.

Yes, this is kopiandproperty.my’s views and we are NOT stock brokers, not property developer, not real estate agent and not even affiliated to any financial institutions. There are also no links below to join any property investment course yeah. Cheers.

Property News Malaysia? Sign up for daily investment news updates (FREE since Nov 2013 and FOREVER). Alternatively, Follow me on Telegram here.

Please LIKE kopiandproperty.my FB page to get daily updates about the property market beyond kopiandproperty.my articles. Else, follow me on Twitter here.

Next suggested article: Property market 1H 2021. Overview

Leave a Reply