Malaysia bankruptcy cases during MCO period hit over 11,000 people. Is this high or is this low?

The article below was first written in September 2021 based on earlier number of bankruptcy. Then, today, we have one latest number from the Wan Junaidi Tuanku Jaafar. It’s now updated with the latest numbers. (If you like to know how people could become a bankrupt, click here to read)

This MCO period was stated to be between March 2020 to September 2021. This is around 19 months. If we divide this into a monthly basis, that’s 11,000 divided by 19 months and we come to 579 per month or slightly below 7,000 bankrupt declarations per year. Is this considered high or low?

Typical number of for bankruptcy in Malaysia?

To put this into context, during periods before MCO, the typical number of bankruptcy numbers are over 20,000 per year. (As per ex Minister of Finance YB Lim Guan Eng). Please refer to this earlier article in kopiandproperty.my -“Lim said 100,610 Malaysians are declared bankrupt between 2013-2017”

If you are wondering now, “how come the number of bankruptcy declarations went down during the MCO versus normal period?” The below is one major reason. It got harder to be declared a bankrupt.

RM50,000 owing increased to RM100,000

Usually, a creditor may file for bankruptcy action against the debtor if the debt owing is more than RM50,000. However, with the introduction of the Temporary Measures For Reducing The Impact of Coronavirus Disease 2019 (COVID-19) 2020 [Act 829] which has been enforced on 23.10.2020, the minimum amount has been increased from RM50,000 to RM100,000. This provision is only in force until 31.8.2021. Source: Department of Insolvency, Malaysia.

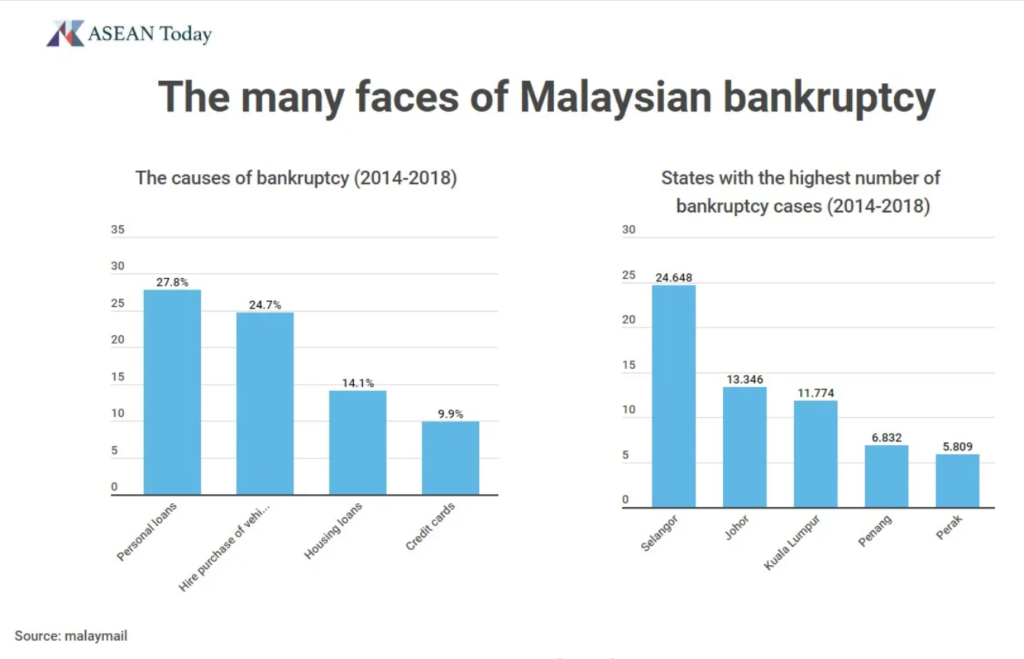

Want to know the reason for bankruptcies? Property is not the top yeah (cannot simply buy a property too). Take a look.

Header Photo Powered by Cheston Choo

Article in malaymail.com Prime Minister Datuk Seri Ismail Sabri Yaakob said 10,317 individuals declared bankrupt throughout the movement control order (MCO) period between March 2020 and July. He said Selangor had the highest number of individuals declared bankrupt, at 2,555, followed by the Federal Territory (1,288 people) and Johor (792 people). Besides that, a total 1,246 businesses had closed down during the same period.

Ismail Sabri said that based on the input from the Ministry of Finance (MOF), the government did not provide any specific assistance to businesses that closed down and that it, instead, took the approach of giving aid and incentives to support the continuity of businesses. Article in malaymail.com

Would you like to get some usual Q&A on how one could become a bankrupt?

This is the earlier article. Click here to read in full yeah. Bankruptcy in Malaysia. One question about property?

Can a bankrupt transfer his property?

A bankrupt is not allowed to transfer his property to a third party once a Receiving and Adjudication Order has been entered against him. As soon as a person is declared bankrupt, any of his property shall be automatically vested upon the DGI.

Let’s hope with the economy reopening fully, businesses would thrive again and we would have less of these bankruptcy in Malaysia cases too. Remember to do due diligence in all our investments. The reason is because the amount involved is usually big and thus, there’s always the risk of bankruptcy if we are not careful or overlooked some details about what we are investing into.

Property News Malaysia? Sign up for daily investment news updates (FREE since Nov 2013 and FOREVER). Alternatively, Follow me on Telegram here.

Please LIKE kopiandproperty.my FB page to get daily updates about the property market beyond kopiandproperty.my articles. Else, follow me on Twitter here.

Next suggested article: Property price mus tnot keep rising as if the sky is the limit!

Header Image by Simon Hill from Pixabay

Leave a Reply