Loan Rejection. Why do banks refuse to lend to some of us?

Article was first written in 2018. Still applicable today. Edited on 7th October 2021.

Banks are no longer lending. Loan rejection is rising?

A banker friend said something which I agree wholeheartedly. This banker friend has heart, not just thinking about money. He said that many people say banks are not lending anymore but the truth is, the borrowers must also play their part lah. If banks take too high risks, then what will happen to their shareholders?

If banks suffer losses. (Google for some of those banks who suffer huge losses in 1998) What about their employees? They may lose their job. Please do not try to guess which banker friend. I only have around 78 banker friends ok. (maybe more) I share this in a story format and perhaps we see whether it makes sense yeah. Loan rejection should be the case for many of the scenarios before if we think logically.

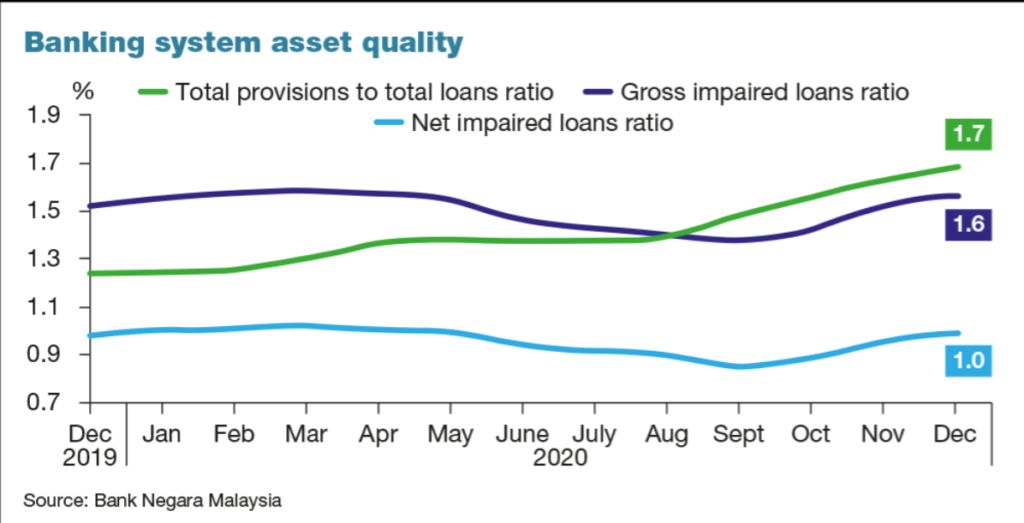

By the way, this is the state of the banks’ loan impairment. (Still low and if it gets higher and higher, it’s not good)

Header Photo Powered by Cheston Choo

Are banks too stringent and thus increasing loan rejection numbers?

We do have people saying that the banks are not really lending or that they are too stringent. Actually, the banks are also saying that they are not to be blamed because they are still lending. Anyway, if banks do not lend, then what else do you want the banks to do? They exist because they want profits from LENDING… Plus their investments but generally they earn money when they lend and people PAY THEM.

If they do not lend, their staffs would be worried… would the banks still need so many of them if they are not lending money at all…? Maybe some of my 78 banker friends may also lose their job! Hopefully banks will continue lending lah. Okay, for the question of why must the banks lend ever higher to buyers? Why loan rejection cannot be an actual solution? On a separate matter, if you like to avoid your loan from becoming a loan rejection statistics, here are some tips. Happy reading. (click here)

Let’s look at these four loan lending or loan rejection scenarios

Assuming there are 4 units up for sale in a certain location. Median price is RM500,000 for similar units elsewhere. We assume the buyer’s financial status is healthy yeah. Not with huge credit card debts, not with lots of personal loans etc. Someone who can get his loan approved and that he could afford the RM500,000 home.

Seller 1 sells his unit at RM500,000 and the buyer asked for 90 percent loan at RM450,000. Bank approved. Happy!

Seller 2 has some minor renovations and wanted RM520,000. Buyer likes it, applied for 90 percent loan at RM468,000. Valuer agrees with the value of RM520,000 due to renovation. Bank approved. Happy!

Seller 3’s unit is not well maintained but he wants RM500,000. Buyer thinks it’s ok and applied for 90 percent loan. Bank’s valuer thinks it’s ok. Bank approved because the median price in the area is RM500,000 anyway. Happy.

Seller 4 has EXTENSIVE renovation costing RM100,000. He wants RM550,000. Buyer think it’s value for money! RM500,000 is for units without renovation. This one extensive renovation, yet just priced at RM550,000. He applies for 90 percent loan. Bank approved but only for 85 percent loan after appealing. Buyer aborted the deal. Seller is furious that bank did not approve the loan even though buyer was ready to buy at RM550,000.

Loan Approval or Loan Rejection for Seller 4’s unit?

If you are the bank, would you also approve the buyer for Seller 4’s unit? At 90% loan for RM550,000 value? Means buyer only needs to fork out RM55,000? Or you think the bank was right in offering a 85% loan which meant that the buyer needs to fork out RM82,500 instead? So, the bank will lend RM467,500 instead? By the way, even for the same property, every valuer would have their own expert opinion on the property value. Every buyer would have different preference too.

Banks should be conservative, they are a business with shareholders

As for the banks, they may feel that want to err on the side of caution. If it’s RM550,000 valuation at 90% loan, the bank will be lending out RM495,000. If the buyer defaults in the future, the bank will have to put up the property for sale under auction. Do we realistically think that the bank would be able to sell that property at the original price of RM550,000? I am a licensed auctioneer, I can tell you, the answer is most probably no.

Banks must manage their risks.

Banks need to manage their risks when lending. If they suffer losses, many people will be affected. Shareholders, employees and even the government of the day as they depend on the tax earnings.

As for the buyer, it’s good to note that when banks do this, it could actually benefit you as well. Loan rejection may be a blessing in disguise. Else, you may be paying too much for the property from the banks eyes. That is not good for you nor the bank. Remember, you want to buy as low as possible, not higher than the market.

Okay, the seller may have to take a cut but please understand that the money we pour into renovation does not mean the valuation of the property goes up by the same number.

Happy understanding. (Yes, I still think bank stocks are good dividend stocks with potential capital appreciation)

Property News Malaysia? Sign up for daily investment news updates (FREE since Nov 2013 and FOREVER). Alternatively, Follow me on Telegram here.

Please LIKE kopiandproperty.my FB page to get daily updates about the property market beyond kopiandproperty.my articles. Else, follow me on Twitter here.

Next suggested article: Buy before property price rises in 2022? Ahem…

Leave a Reply