Home price RM250,000 and rental is RM1,000. Worth buying?

This was a very old question but let’s look at this from numbers perspective for this article yeah.

As we assumed, the home price is RM250,000 and rental is RM1000. Let’s also say the maintenance fee is RM150 per month. Now let’s look at a few scenarios.

How YOUNG is the buyer?

If the buyer is 30 years old, then the bank would approve loan period of 35 years. Usually, it’s 35 years as maximum loan period or up to 65 years old, whichever is lower. If the buyer is 30 years old or younger, then she will be able to stretch the loan to 35 years. We assume a down-payment of 10%. The numbers would be as below.

Thus, it’s RM866 per month plus maintenance fee of RM150, thus total which the owner is paying every month is RM866 + RM150 = RM1,016. So, the rental actually COULD NOT cover the repayment + maintenance. So, if we take negative number as no-buy, then this is a no-buy decision.

However, we can also look deeper into the monthly repayment to distinguish between the interest and principal payment too before we make our decision.

If rental is RM1,000 does it cover the interest payment sufficiently?

The below would be the mortgage repayment divided into principal amount and interest amount every year.

On the 1st year, the total repayment is RM10,391. This is RM307.60 for principal and RM588 for interest payment.

Interest payment RM588 plus the maintenance fee of RM150 is a total of RM738 per month for year 1.

If the rental is RM1,000 then this amount already covers both the interest payment and also the maintenance. So number wise, if the owner looks at this for long term, it is still okay to proceed with the purchase.

In fact, what happens to the principal payment and the interest payment is that every year, the interest portion gets smaller while the principal gets bigger. Principal is actually the capital which belongs to the owner. Interest payment belongs to the bank. So, as long as the rental covers interest fully and can cover some portion of the principal, the tenant is making the owner richer every month, slowly.

What happens if the buyer is older?

If the buyer is now 40 years old, then the maximum loan period may only be 25 years (depending on the bank). The calculations are as follows.

The rental of RM1,000 per month could NOT even cover the monthly repayment, let’s not even talk about the maintenance fee yeah.

It’s RM1,000 (rental) minus the repayment of RM1,067 and the maintenance fee of RM150. This is a negative of RM217 every month! Let’s look deeper into the principal and the interest as well yeah. It’s in the chart after the repayment one.

The Principal and the Interest portion for the loan

This time, the principal payment for year 1 is RM511.50 while the interest portion is RM555.51.

Interest portion plus the maintenance fee is RM555.51 + RM150 = RM795.51 per month.

Rental per month is RM1,000. Thus, it still covers the interest plus the maintenance fee and some portion of the principal payment. Thus, if the buyer is taking a long term investment view, it is still a possible buy.

BUT… what about other costs? Renovation? Electrical goods? Stamp duty? Legal Fees? and more?

Yeah, it’s really possible that when we include all these, the actual amount we need to pay is higher than the repayment plus maintenance fee and we will need a much higher monthly rental to cover all these additional costs which is not part of the bank loan. This is why it’s a decision by you, the buyer and not me, the blogger here in kopiandproperty.my

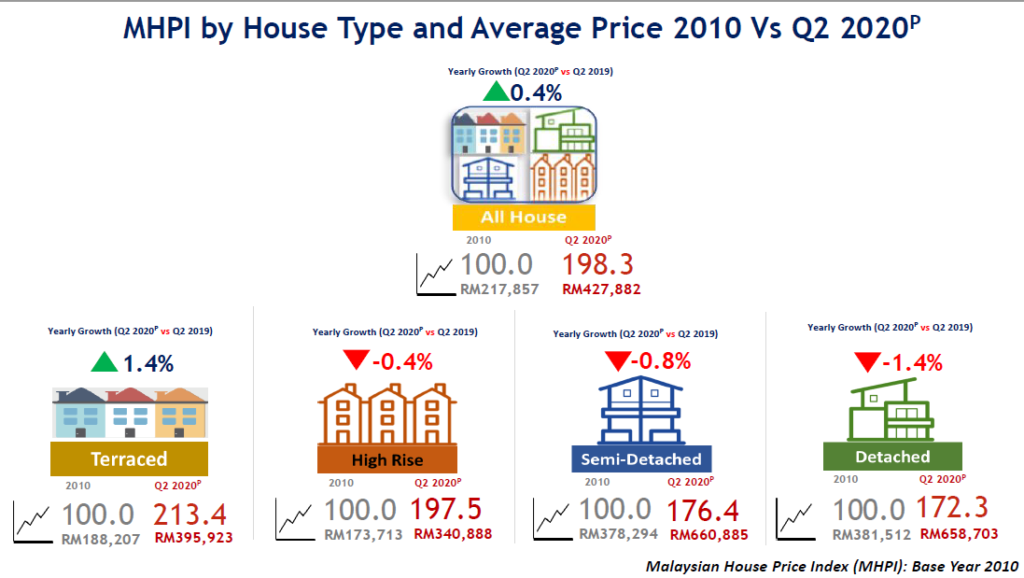

REMEMBER this chart too… okay?

It’s called Malaysia House Price Index (MHPI) and it tells of the typical price increase over a certain period of time. So, while we are obsessed with many of the numbers we discussed above, the home we bought is also increasing in value every year too. Let’s also look at a simple calculation yeah. It’s a comparison of the price change over a period of 10 years. 2010 vs 2020.

Remember the home price we discussed? RM250,000? If every year, the house price increase by just 4%. (much lower than what the MHPI tells us), then it’s RM250,000 x 4% which is equivalent to RM10,000 per year… In other words, the property price increased by RM833 every month. This is why when we buy the right property, chances are we would gain profits when we sell and we could use the profit to continue our next investment and so on.

There are no property listing in kopiandproperty.my

We do not have any property listings. For that you may need to go to iProperty.com.my or PropertyGuru.com.my and take a closer look. We also do not run any property clubs where we offer you any special discounted property. We are also not an agency or have a REN tag, so if you like to buy a property look for your friends yeah. We just want to share with you all the necessary numbers but the decision is ultimately yours. We also do not have any special deals with banks. Please find them yourself.

Disadvantages are also aplenty

There are a lot of disadvantages of property investments too. If you prefer a faster investment return, please do skip property. It’s super slow. In the mean time, do enough study before sign on that Sale and Purchase Agreement yeah. This is not like buying a fish from the market. That one, if you make a mistake, buy again. For property, if you make a mistake, it is a setback of many, many years. Happy reading and please do share any article you find beneficial to you.

Property News Malaysia? Sign up for daily investment news updates (FREE since Nov 2013 and FOREVER). Alternatively, Follow me on Telegram here.

Please LIKE kopiandproperty.my FB page to get daily updates about the property market beyond kopiandproperty.my articles. Else, follow me on Twitter here.

Next suggested article: If property price keep rising too fast, sooner or later, it will suddenly stop and drop

Leave a Reply